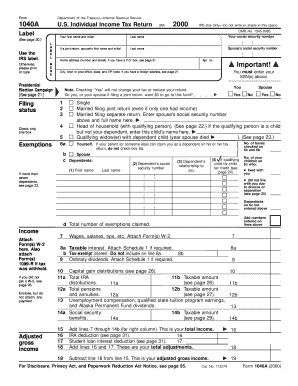

Get Irs 1040-a 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-A online

How to fill out and sign IRS 1040-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period commenced unexpectedly or perhaps you just overlooked it, it might likely lead to issues for you. IRS 1040-A is not the simplest form, but there’s no need to panic regardless.

By using our user-friendly solution, you will discover the optimal way to complete IRS 1040-A even in times of significant time constraints. You merely need to adhere to these simple guidelines:

With our comprehensive digital solution and its beneficial tools, filling out IRS 1040-A becomes more straightforward. Don’t hesitate to utilize it and spend more time on hobbies and interests instead of paperwork.

- Open the document utilizing our expert PDF editor.

- Input all necessary details in IRS 1040-A, utilizing fillable fields.

- Add images, ticks, checkmarks, and text boxes as required.

- Repeated information will be auto-filled after the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will receive guidance for much smoother completion.

- Remember to include the filing date.

- Create your unique electronic signature once and place it in the relevant areas.

- Review the information you have entered. Rectify errors if necessary.

- Click Done to finish editing and select your delivery method. You will have the option to use online fax, USPS, or email.

- You can also download the document to print later or upload it to cloud services like Dropbox, OneDrive, etc.

How to modify Get IRS 1040-A 2000: personalize forms online

Place the appropriate document management features at your disposal. Process Get IRS 1040-A 2000 with our dependable tool that includes editing and eSignature capabilities.

If you wish to finish and sign Get IRS 1040-A 2000 online without any hassle, then our internet-based option is the perfect choice. We present an extensive template-based library of ready-to-use documents you can adjust and finalize online.

Moreover, there's no need to print the document or rely on external solutions to make it fillable. All essential tools will be immediately accessible for your use upon opening the document in the editor.

In addition to the aforementioned features, you can protect your document with a password, add a watermark, convert the file to the necessary format, and much more.

Our editor simplifies the process of completing and validating the Get IRS 1040-A 2000. It allows you to manage everything related to document handling.

Furthermore, we consistently ensure that your experience working with files is secure and adheres to major regulatory standards. All these aspects enhance user experience with our solution. Access Get IRS 1040-A 2000, apply the required edits and modifications, and download it in the preferred file format. Try it out today!

- Modify and annotate the template

- The upper toolbar contains tools that assist you in highlighting and obscuring text, excluding images and graphic components (lines, arrows, checkmarks, etc.), applying your signature, initializing, dating the document, and more.

- Organize your documents

- Utilize the left toolbar if you prefer to rearrange the document or remove pages.

- Make them shareable

- If you wish to create the document fillable for others and distribute it, use the tools on the right to add various fillable fields, signatures and dates, text boxes, etc.

Get form

Related links form

The W-2 form provides details about your annual wages and tax withholding from your employer, while IRS 1040-A is the form you file to report your total income and calculate your taxes. Essentially, the W-2 summarizes your earnings and tax deductions, and you then use this information to complete your IRS 1040-A. Understanding this difference is crucial for accurate tax filing and ensuring compliance with IRS requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.