Get Irs 13614-c 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13614-C online

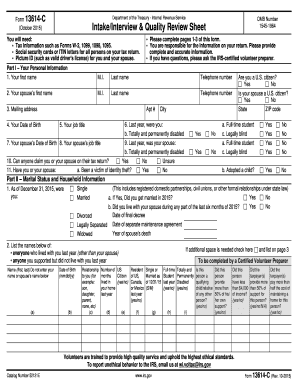

The IRS 13614-C is an essential form used for intake during the tax preparation process. This guide will provide a comprehensive step-by-step approach to assist users in accurately completing the form online, ensuring all necessary information is gathered for tax filing purposes.

Follow the steps to fill out the IRS 13614-C online

- Press the ‘Get Form’ button to access the IRS 13614-C and open it in your preferred editor.

- Complete Part I, which requires your personal information. Fill in your first name, middle initial, last name, and telephone number. Repeat this for your spouse if applicable.

- Provide your mailing address, including apartment number, city, state, and ZIP code. Indicate your date of birth and job title.

- Answer questions related to citizenship, any past disabilities, and identity theft concerns.

- Move to Part II, which focuses on marital status and household information. Indicate whether you are single or married and provide details about living arrangements.

- List everyone who lived with you last year along with their dates of birth and their relationship to you.

- In Part III, answer questions regarding your income sources from the previous year, including wages, self-employment income, interest, and other various categories.

- Proceed to Part IV to provide information about any expenses you or your spouse incurred during the last year.

- Part V requires you to indicate any significant life events that may have occurred and their impact on your finances.

- Report on health care coverage in Part VI, making sure to note if you, your spouse, or any dependents had health coverage and if you received the necessary tax forms.

- Follow up with Part VII, where you will respond to questions regarding filing status and other refund options.

- Finally, review the information thoroughly and ensure all sections are completed accurately before saving, downloading, or printing the form.

Complete your IRS 13614-C form online today to facilitate your tax preparation.

Get form

Related links form

The 4506 C form is used to request a copy of tax returns from the IRS or to authorize the IRS to send tax transcripts to a third party. This form is particularly useful for those who need to verify income or resolve discrepancies. While it is a separate document from the IRS 13614-C, having both may streamline your tax preparation process. Using uslegalforms can help clarify the purpose of both forms and optimize your filing experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.