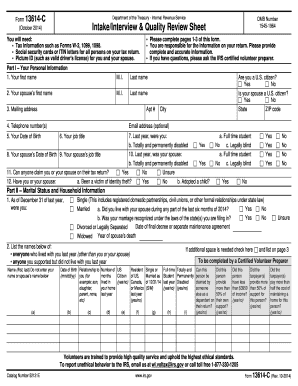

Get Irs 13614-c 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 13614-C online

How to fill out and sign IRS 13614-C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren't linked to document management and legal processes, submitting IRS documents can be rather challenging.

We recognize the importance of accurately filling out documents.

Utilizing our robust solution will enable professional completion of IRS 13614-C, making everything convenient and secure for your workflow.

- Click the button Get Form to access it and begin editing.

- Complete all required fields in your file using our user-friendly PDF editor. Turn on the Wizard Tool to facilitate the process significantly.

- Ensure the accuracy of the information provided.

- Add the date of submitting IRS 13614-C. Use the Sign Tool to create your own signature for the document's validation.

- Finish editing by selecting Done.

- Send this document to the IRS in the most convenient way for you: via email, with virtual fax, or postal service.

- You may print it on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to Modify Get IRS 13614-C 2014: Personalize Forms Online

Utilize the features of the versatile online editor while completing your Get IRS 13614-C 2014. Leverage the array of tools to swiftly fill in the blanks and supply the necessary information in no time.

Creating documents can be time-consuming and expensive unless you have pre-prepared fillable forms that you can complete electronically. The easiest method to handle the Get IRS 13614-C 2014 is to employ our expert and multi-functional online editing solutions. We equip you with all the vital tools for quick form completion and allow you to make any alterations to your forms, customizing them to meet any requirements. Furthermore, you can add comments on the modifications and leave notes for other parties involved.

Here's what you can accomplish with your Get IRS 13614-C 2014 in our editor:

Managing the Get IRS 13614-C 2014 in our robust online editor is the quickest and most effective approach to organize, submit, and share your documents the way you need them from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-connected device. All forms you create or complete are securely stored in the cloud, ensuring you can always retrieve them when required and that you won’t lose them. Stop wasting time on manual document filling and eliminate paperwork; accomplish everything online with minimum effort.

- Fill out the empty fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize crucial information with a chosen color or underline it.

- Hide sensitive information using the Blackout tool or simply delete it.

- Insert images to illustrate your Get IRS 13614-C 2014.

- Substitute the original text with one that matches your requirements.

- Add comments or sticky notes to communicate with others regarding the updates.

- Include additional fillable fields and assign them to specific recipients.

- Secure the template with watermarks, insert dates, and bates numbers.

- Distribute the documents in various methods and save them on your device or the cloud in different formats after you finish editing.

Get form

Related links form

Typically, once identity verification is completed, the IRS takes around six to eight weeks to process and approve a refund. However, this timeframe may vary depending on specific circumstances, such as the complexity of the tax return. Staying updated on your refund status can provide peace of mind as you await your funds.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.