Loading

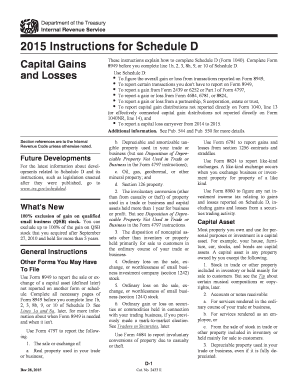

Get Irs 1040 Schedule D Instructions 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule D Instructions online

The IRS 1040 Schedule D Instructions detail the process of reporting capital gains and losses for tax purposes. This guide provides step-by-step instructions on filling out the form online, ensuring clarity and ease of use for all individuals, regardless of their tax experience.

Follow the steps to complete the Schedule D Instructions effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Form 8949 prior to filling out lines 1b, 2, 3, 8b, 9, or 10 of Schedule D. This form records individual sales or exchanges of capital assets.

- Segment your transactions based on holding periods: report short-term gains or losses in Part I, and long-term in Part II.

- To report aggregate totals for transactions without adjustments, enter the summaries for short-term transactions on line 1a and long-term transactions on line 8a.

- Enter any capital gain distributions received during the year on line 13 of Schedule D.

- If reporting the sale of your primary home, complete Form 8949 first, and then transfer the information to Schedule D.

- For partnership interests or when dealing with small business stock, ensure you understand the specific reporting methods for losses and gains.

- Double-check all entries, ensuring that any necessary adjustments are recorded accurately before finalizing.

- Once completed, save changes, download, print, or share the form as needed.

Complete your documents online to make filing easier and more efficient.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Anyone who has sold a capital asset and realized a gain or loss should consider filing IRS 1040 Schedule D. This includes individuals who sold stocks, bonds, or real estate. Additionally, you're required to report if you received capital gains distributions from mutual funds. The IRS 1040 Schedule D Instructions detail eligibility criteria and help ensure proper compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.