Loading

Get Irs 1120-ric 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-RIC online

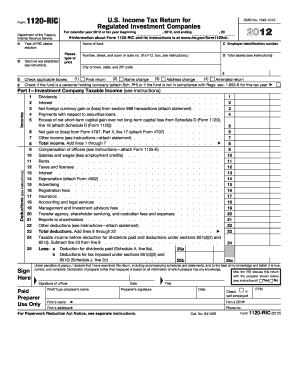

Filling out the IRS Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies, can be intricate. This guide aims to provide a clear, step-by-step approach to assist users in completing the form accurately and effectively online.

Follow the steps to successfully complete the IRS 1120-RIC online

- Click ‘Get Form’ button to retrieve the form and open it in your online editor.

- Enter the date when the fund was established in the appropriate field.

- Fill out the name of the fund and the Employer Identification Number (EIN) in the designated fields.

- Provide the total assets of the fund by entering the respective dollar amount in the given section.

- Indicate applicable checkboxes, if any of the situations such as final return, name change, address change, or amended return apply to your situation.

- Complete Part I by entering all relevant income details such as dividends, interest, and net foreign currency gains in their respective fields.

- Proceed to the deductions section and fill in the appropriate expenses such as compensation of officers, salaries, rents, and other deductions as applicable.

- Calculate the taxable income by subtracting total deductions from total income and enter the resulting amount.

- If applicable, complete the deductions for dividends paid section and provide the necessary details.

- Review all sections of the form to ensure accuracy and completeness.

- Finally, save your changes, and then options will be available to download, print, or share the completed form.

Start filling out your IRS 1120-RIC online today for accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file IRS 1120 on your own if you feel comfortable navigating the form and the required guidelines. However, the filing process can be complex, and mistakes can be costly. Consider using tools and services from uslegalforms to simplify the process and ensure that you submit accurate information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.