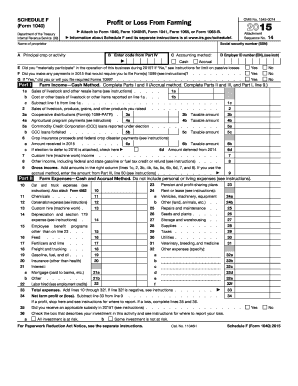

Get Irs 1040 - Schedule F 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule F online

How to fill out and sign IRS 1040 - Schedule F online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or perhaps you merely overlooked it, it could potentially cause issues for you. IRS 1040 - Schedule F is not the easiest document, but there is no need for concern in any event.

By utilizing our ultimate service, you will learn how to complete IRS 1040 - Schedule F even in times of severe time constraints. All you need to do is adhere to these basic instructions:

With this comprehensive digital solution and its effective tools, completing IRS 1040 - Schedule F becomes more convenient. Do not hesitate to utilize it and spend more time on hobbies rather than on managing paperwork.

- Open the document with our robust PDF editor.

- Complete the necessary information in IRS 1040 - Schedule F, utilizing the fillable fields.

- Add visuals, crosses, checkboxes, and text boxes, if required.

- Subsequent identical fields will be filled in automatically after the first entry.

- If you encounter issues, activate the Wizard Tool. You will receive helpful hints for simpler submission.

- Remember to include the filing date.

- Create your personalized e-signature once and insert it into the needed areas.

- Review the information you have input. Make corrections if necessary.

- Click on Done to complete modifications and choose the method of submission. There is an option to use online fax, USPS, or e-mail.

- It is feasible to download the document to print later or upload it to cloud storage options like Dropbox, OneDrive, etc.

How to Modify IRS 1040 - Schedule F 2015: Personalize Forms Online

Your swiftly alterable and adaptable IRS 1040 - Schedule F 2015 template is readily accessible. Maximize our collection with an integrated online editor.

Do you delay finishing IRS 1040 - Schedule F 2015 because you just aren’t sure where to start and how to progress? We empathize with your situation and provide you with an excellent tool that has nothing to do with conquering your hesitation!

Our digital repository of ready-to-use templates allows you to navigate and select from numerous fillable documents designed for various uses and situations. However, acquiring the file is only the beginning. We furnish you with all the necessary tools to complete, validate, and modify the document of your selection without leaving our site.

All you must do is open the file in the editor. Review the wording of IRS 1040 - Schedule F 2015 and verify whether it meets your requirements. Start completing the form by utilizing the annotation tools to give your document a more structured and polished appearance.

In summary, along with IRS 1040 - Schedule F 2015, you’ll receive:

With our professional solution, your finalized forms will generally be legally binding and fully secured. We commit to protecting your most sensitive information.

Acquire what is necessary to generate a professional-looking IRS 1040 - Schedule F 2015. Make the right decision and explore our platform now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and amend the existing text.

- If the document is meant for others as well, you can incorporate fillable fields and distribute them for others to fill out.

- Once you complete the template, you can download the document in any available format or select various sharing or delivery options.

- A robust set of editing and annotation instruments.

- An integrated legally-binding eSignature capability.

- The option to create forms from scratch or utilizing the pre-uploaded template.

- Compatibility with multiple platforms and devices for enhanced convenience.

- Various options for protecting your documents.

- A broad spectrum of delivery choices for easier sharing and dispatching of documents.

- Adherence to eSignature regulations governing the use of eSignature in online transactions.

Get form

Related links form

Other earned income may include bonuses, commissions, and freelance payments that fall outside typical payroll earnings. It’s important to keep thorough records of all these earnings for your IRS 1040 - Schedule F filing. Ensure to categorize this correctly to gain the benefits associated with your total earned income.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.