Loading

Get Irs 1040 - Schedule E 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

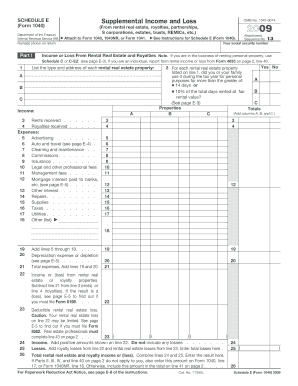

Filling out the IRS 1040 - Schedule E is essential for reporting supplemental income and losses. This guide will provide you with clear and detailed steps to complete the form online effectively.

Follow the steps to fill out Schedule E accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including your name and social security number, as indicated at the top of the form.

- In Part I, list the type and address of each rental real estate property in the designated fields.

- Report the income received from rents and royalties in the appropriate sections under 'Income' by filling in the amounts you collected.

- List all relevant expenses associated with each rental property in the 'Expenses' section. This includes advertising, cleaning and maintenance, mortgage interest, and other related costs.

- Calculate the total expenses by adding the figures from the 'Expenses' section. Enter the total in the designated field.

- Determine your net income or loss by subtracting the total expenses from the total income. Input this value in the corresponding box.

- Proceed to Parts II through V if applicable, completing each section based on your income from partnerships, S corporations, and other sources of supplemental income as detailed in the instructions.

- After completing all sections, review all entries for accuracy before proceeding.

- Save changes, download, print, or share the form as needed.

Start filling out your IRS 1040 - Schedule E online today for accurate income reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS Form 1040 Schedule E is a supplementary form used to report income or losses from rental real estate, partnerships, S corporations, estates, and trusts. It is essential for taxpayers with rental income to complete. Using this form correctly can enhance your tax return and improve your overall tax situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.