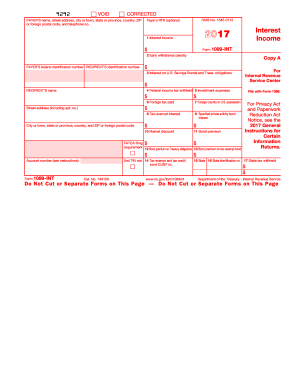

Get Irs 1099-int 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-INT online

Filling out the IRS 1099-INT form online is an essential task for reporting interest income. This guide provides clear and step-by-step instructions to help you navigate the form successfully, ensuring you meet all necessary requirements.

Follow the steps to complete your IRS 1099-INT form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the 'PAYER’S name' section, enter the name, street address, city, state, postal code, and telephone number of the entity paying the interest.

- Provide the 'PAYER’S federal identification number' in the appropriate box.

- Enter the recipient's information by filling in the 'RECIPIENT’S name,' 'street address,' 'city or town,' 'state or province,' 'ZIP or foreign postal code,' and the 'RECIPIENT’S identification number.'

- In box 1, report the total interest income paid to the recipient for the year.

- If applicable, input any early withdrawal penalty amounts in box 2.

- Complete boxes 3 through 17 according to the relevant interest and other monetary figures that pertain to the recipient.

- Review all entered information for accuracy before proceeding.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your IRS 1099-INT form online today to ensure accurate reporting of interest income.

Get form

The rule for IRS 1099-INT states that you must receive this form if you earn $10 or more in interest during the year. This income must be reported on your tax return, as non-reporting could lead to penalties. Familiarizing yourself with these rules ensures you remain compliant and helps you maximize your tax benefits. Resources available on uslegalforms can assist you with understanding these guidelines more thoroughly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.