Get Irs 1040 - Schedule C-ez 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C-EZ online

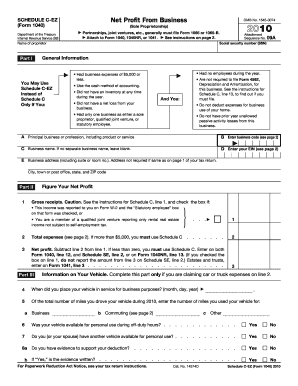

The IRS 1040 - Schedule C-EZ is a simplified form used to report income from a sole proprietorship. This guide provides clear, step-by-step instructions for effectively completing the form online, ensuring users understand each component.

Follow the steps to fill out the IRS 1040 - Schedule C-EZ online.

- Press the ‘Get Form’ button to access the IRS 1040 - Schedule C-EZ and open it in your editor.

- In Part I, enter your name as the proprietor and your social security number. This identifies you as the business owner.

- Provide your principal business activity description and enter the corresponding six-digit business code.

- Complete the business name field if you have a separate name for your business. If not, leave it blank.

- Input your employer identification number (EIN) if applicable. If you do not have one, simply leave this field empty.

- List your business address. Include the street address, city, state, and ZIP code. This should be left blank if it matches the address on your tax return.

- Proceed to Part II, where you will need to enter your gross receipts from your business on line 1. Ensure this includes all taxable income received.

- On line 2, detail your total business expenses, ensuring they are $5,000 or less to qualify for Schedule C-EZ.

- Calculate your net profit on line 3 by subtracting total expenses from gross receipts. If this figure is zero or negative, you must use Schedule C.

- If applicable, complete Part III regarding vehicle expenses. Provide details on the business use of your vehicle, including the total miles driven for business.

- Review the form thoroughly to ensure all entries are accurate and complete.

- Once completed, save your changes, download the form for your records, and print or share it as necessary.

Complete your IRS 1040 - Schedule C-EZ online today for an efficient filing experience.

Get form

The 1040-SR is specifically designed for seniors, offering larger print and a simplified layout, making tax filing easier for older adults. Unlike the 1040 EZ, which is phased out, the 1040-SR can incorporate many tax scenarios, including those using the IRS 1040 - Schedule C-EZ for self-employment. It's crucial to choose the form that best fits your age and tax situation. U.S. Legal Forms can assist you in understanding these differences thoroughly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.