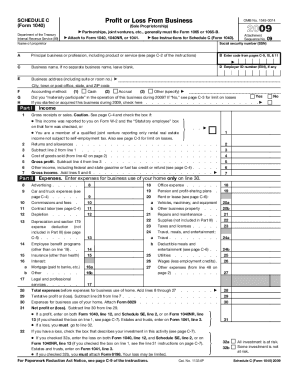

Get Irs 1040 - Schedule C 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule C online

How to fill out and sign IRS 1040 - Schedule C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period began unexpectedly or you merely overlooked it, it would likely cause issues for you. IRS 1040 - Schedule C is not the easiest one, but you have no reason to be concerned in any situation.

By utilizing our ultimate service, you will learn how to complete IRS 1040 - Schedule C in times of significant time constraints. You just need to adhere to these basic instructions:

With this comprehensive digital solution and its beneficial tools, filling out IRS 1040 - Schedule C becomes simpler. Don’t hesitate to utilize it and invest more time in hobbies and interests instead of organizing documents.

Access the document using our sophisticated PDF editor.

Input all the required information in IRS 1040 - Schedule C, utilizing the fillable fields.

Add graphics, checks, tick boxes, and text fields, if necessary.

Repeating fields will be inserted automatically after the initial entry.

If you experience any confusion, use the Wizard Tool. You will find tips for much simpler submissions.

Remember to include the application date.

Make your distinctive signature once and place it in the necessary lines.

Verify the information you have entered. Rectify any mistakes as required.

Select Done to finish editing and choose how you wish to submit it. You have the option to use online fax, USPS or email.

Additionally, you can download the document for later printing or upload it to cloud services like Google Drive, OneDrive, etc.

How to Alter IRS 1040 - Schedule C 2009: Personalize Forms Online

Experience a hassle-free and paperless method of managing your tasks with IRS 1040 - Schedule C 2009. Utilize our reliable online service and conserve a significant amount of time.

Creating each form, including IRS 1040 - Schedule C 2009, from the ground up consumes too much time; thus, having a proven platform of pre-prepared document templates can greatly enhance your efficiency.

However, dealing with them can be challenging, particularly regarding documents in PDF format. Fortunately, our vast repository includes a built-in editor that allows you to swiftly complete and modify IRS 1040 - Schedule C 2009 without needing to leave our site, saving you time in altering your documents. Here’s what you can achieve with your form using our service:

Whether you need to finish editable IRS 1040 - Schedule C 2009 or any other template in our inventory, you’re on the right path with our online document editor. It's user-friendly and secure, requiring no specialized skills.

Our web-based tool is designed to manage practically anything you can consider concerning document editing and completion. Move away from traditional methods of handling your forms. Opt for a professional solution to simplify your tasks and reduce paper dependency.

- Step 1. Locate the necessary document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our expert editing tools that let you add, delete, annotate, and highlight or obscure text.

- Step 4. Create and add a legally-binding signature to your form by selecting the sign option from the top toolbar.

- Step 5. If the template layout doesn't meet your needs, use the tools on the right to remove, insert, and rearrange pages.

- Step 6. Insert fillable fields so other individuals can be invited to complete the template (if necessary).

- Step 7. Distribute or send the form, print it, or choose the format in which you wish to download the file.

Calculating Schedule C income involves summarizing your total business revenue and subtracting your allowable business expenses. Start with your gross income, then deduct expenses such as utilities, materials, and other costs related to your business. The final figure will give you your net income, which you'll report on your IRS 1040. If you need help with this process, consider using uslegalforms for user-friendly templates and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.