Loading

Get Irs 1041 - Schedule I 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule I online

Filling out the IRS 1041 - Schedule I can seem daunting, but this guide provides clear steps to help you navigate the process with ease. By following these instructions, you can efficiently complete your form online and ensure that all necessary information is accurately reported.

Follow the steps to fill out the IRS 1041 - Schedule I online.

- Click ‘Get Form’ button to obtain the IRS 1041 - Schedule I form and open it in the editor.

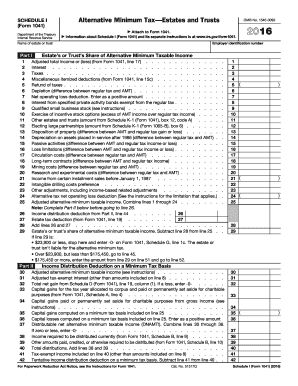

- Enter the estate’s or trust’s share of alternative minimum taxable income in the corresponding fields on the form. This section captures the necessary income amounts relevant to the alternative minimum tax.

- Fill in the adjusted alternative minimum taxable income by referring to the instructions provided with the form. This involves careful calculations based on provided income and deduction details.

- Report total net gains from Schedule D by entering amounts in the designated lines, ensuring that any losses are noted as -0-.

- Complete the sections regarding capital gains paid or permanently set aside for charitable purposes, according to the instructions, as this affects your tax calculation.

- Combine the distributable net alternative minimum taxable income by summing the required lines. If this amount is zero or less, you should indicate -0- on the form.

- Fill out the income required to be distributed currently from Form 1041, Schedule B, line 9, and include any other relevant amounts from Schedule B.

- Calculate the total distributions by adding the amounts from the prior steps, ensuring accuracy to facilitate proper tax liability calculations.

- Complete the tentative income distribution deduction section, which involves subtracting any related amounts previously noted.

- Perform the necessary calculations related to the alternative minimum tax credit and enter the results in the provided fields to finalize your totals.

- Once all sections are complete, save your changes, then download, print, or share the form as needed to ensure submission deadlines are met.

Start filling out the IRS 1041 - Schedule I online today to ensure your tax responsibilities are managed effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The minimum income threshold for filing IRS 1041 - Schedule I is generally set at $600 for estates and trusts. If your estate or trust's gross income exceeds this amount, you must file. Keep in mind that some states might have different thresholds, so it's beneficial to check local regulations as well.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.