Loading

Get Irs 1041 - Schedule D 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule D online

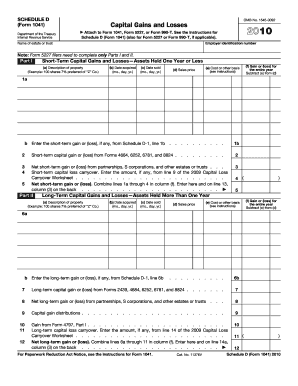

Filling out the IRS 1041 - Schedule D online can streamline the process of reporting capital gains and losses for estates and trusts. This guide provides clear, step-by-step instructions to help users accurately complete the form while ensuring compliance with IRS regulations.

Follow the steps to complete the IRS 1041 - Schedule D online efficiently.

- Click ‘Get Form’ button to access the IRS 1041 - Schedule D form and open it for editing.

- Fill in the employer identification number and the name of the estate or trust at the top of the form.

- Proceed to Part I for short-term capital gains and losses. List each asset held for one year or less, including its description, acquisition date, sale date, sales price, cost basis, and calculate the gain or loss.

- After completing Part I, move on to Part II for long-term capital gains and losses. Similar to Part I, list assets held for more than one year with their relevant details.

- Complete Part III to summarize the results from Parts I and II, entering net gains or losses for both short-term and long-term assets.

- If applicable, fill in Part IV for capital loss limitation, determining the smaller amount between the calculated losses or $3,000.

- Finish with Part V, calculating any necessary taxes based on capital gains, ensuring that all entries align with the established protocols.

- Once all sections are complete, review your entries for accuracy. Save changes to the document, then download, print, or share the form as needed.

Start filling out your IRS 1041 - Schedule D online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, it is essential to list every transaction on Schedule D for accurate reporting of capital gains and losses. This ensures transparency and compliance with IRS guidelines. Utilizing the IRS 1041 - Schedule D correctly minimizes the risk of mistakes that could lead to audits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.