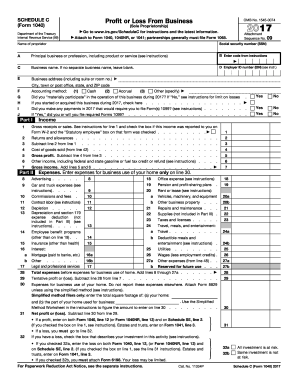

Get Irs 1040 - Schedule C 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule C online

How to fill out and sign IRS 1040 - Schedule C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced unexpectedly or you simply overlooked it, it could likely cause complications for you. IRS 1040 - Schedule C is not the most straightforward one, but you have no cause for concern in any instance.

With our user-friendly service, you will grasp how you can complete IRS 1040 - Schedule C even in circumstances of urgent time constraints. All you need to do is adhere to these simple guidelines:

With this comprehensive digital solution and its expert tools, completing IRS 1040 - Schedule C becomes more manageable. Don’t hesitate to try it and enjoy more time on personal interests instead of document preparation.

Access the document in our advanced PDF editor.

Input the necessary information in IRS 1040 - Schedule C, using fillable fields.

Insert images, marks, checkboxes, and text boxes, if needed.

Repeating fields will be included automatically after the initial entry.

If you encounter any issues, activate the Wizard Tool. You will receive helpful advice for easier completion.

Always remember to add the application date.

Create your distinct e-signature once and place it in the required areas.

Review the information you have entered. Rectify errors if necessary.

Click Done to conclude modifications and select how you will dispatch it. You have the option to utilize virtual fax, USPS, or email.

You can even download the document for later printing or upload it to cloud storage.

How to Modify IRS 1040 - Schedule C 2017: Tailor Forms Online

Experience a hassle-free and paperless approach to adjust IRS 1040 - Schedule C 2017. Utilize our dependable online service and save significant time.

Creating every form, including IRS 1040 - Schedule C 2017, from the beginning takes a lot of time, so having a reliable platform of pre-loaded document templates can significantly enhance your productivity.

However, altering them can be difficult, particularly with documents in PDF format. Fortunately, our extensive library includes an integrated editor that allows you to swiftly complete and modify IRS 1040 - Schedule C 2017 without leaving our website, eliminating hours spent on document completion. Here’s how to handle your document using our tools:

Whether you need to finalize an editable IRS 1040 - Schedule C 2017 or any other template available in our collection, you’re on the right track with our online document editor. It's user-friendly and secure, requiring no specific skills. Our web-based solution is designed to manage practically everything you can imagine regarding file editing and processing.

Set aside the conventional method of handling your documents. Opt for a professional solution to help you streamline your tasks and reduce paper dependence.

- Step 1. Find the required document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing tools that enable you to add, delete, annotate, and highlight or obscure text.

- Step 4. Generate and incorporate a legally-binding signature into your document by using the sign option from the top menu.

- Step 5. If the template's format isn't to your liking, use the tools on the right to delete, add, and rearrange pages.

- Step 6. Include fillable fields so others can be invited to complete the template (if applicable).

- Step 7. Distribute or send the form, print it, or select the format in which you'd like to download the document.

Filing your IRS 1040 - Schedule C involves filling out the form with your business income and expenses. You will attach this form to your IRS Form 1040 when you file your annual tax return. Be sure to double-check the entries for accuracy before submission. If you need assistance, USLegalForms offers resources to help you file correctly and efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.