Loading

Get Irs 1040a Or 1040 Schedule R 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040A or 1040 Schedule R online

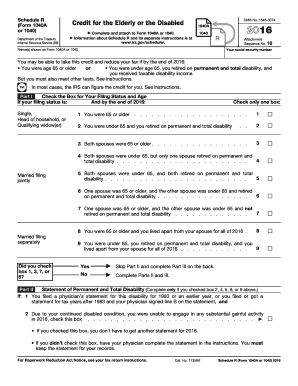

This guide provides a clear and comprehensive overview of how to complete the IRS 1040A or 1040 Schedule R form online. Whether you are eligible for the credit for the elderly or disabled, this step-by-step approach will help you navigate the form with ease.

Follow the steps to fill out the IRS 1040A or 1040 Schedule R online.

- Press the ‘Get Form’ button to access the IRS 1040A or 1040 Schedule R form, allowing you to open and start editing the document.

- Begin by entering your name and social security number as indicated on the form. This information is essential for the IRS to identify your tax records.

- In Part I, check the box that corresponds to your filing status and age. This section requires you to select one option regarding your age or disability status at the end of the tax year.

- If you selected any boxes in Part I that pertain to disability (boxes 2, 4, 5, 6, or 9), proceed to Part II and check the box indicating you have a physician’s statement of permanent and total disability, if applicable.

- Complete Part III to figure your credit. Follow the instructions for lines 10 through 22. This involves entering amounts based on the boxes you checked in Part I and calculating your eligibility for the credit.

- After filling in all necessary information, review your entries for accuracy. Ensure all required fields are completed.

- Once confirmed, save your changes. You may also choose to download, print, or share the form as needed.

Start filling out your IRS 1040A or 1040 Schedule R online today to secure your credit!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You need a Form 1040 if you have earned income, if your income exceeds a certain threshold, or if you have specific tax credits to claim. Additionally, if you want to take advantage of deductions, you should definitely consider the IRS 1040A or 1040 Schedule R. It’s advisable to review your financial situation closely or consult a tax professional for guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.