Loading

Get Sc Dor Sc1065 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1065 online

Filing the SC DoR SC1065 online is a straightforward process designed for partnerships operating in South Carolina. This guide provides step-by-step instructions to help you accurately complete the form and ensure compliance with state requirements.

Follow the steps to successfully complete the SC DoR SC1065 form

- To access the form, click the ‘Get Form’ button. This will allow you to download the SC DoR SC1065 document and open it in your editor of choice.

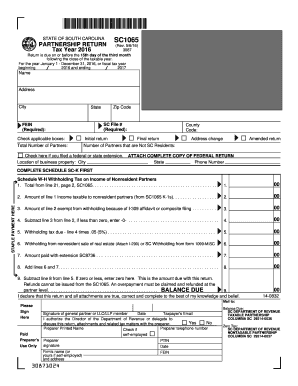

- Begin by completing the basic information at the top of the form, including the partnership's name, address, and contact details. Ensure that the SC File Number and FEIN are accurately entered.

- Indicate the type of return you are filing by checking the appropriate boxes — if it is your initial, final, amended return, or if you are reporting an address change. Each checkbox serves a specific purpose in the filing process.

- Fill out Schedule SC-K. This part requires you to adjust federal Schedule K items, detailing amounts allocated to South Carolina. Follow the instructions closely for correct entry of adjustments.

- Move on to the apportionment section. Calculate the total sales or gross receipts, and determine the apportionment factor to establish the portion of income taxable in South Carolina.

- Complete SC1065 K-1 for each partner to report their share of the partnership's income. Ensure to distribute copies of K-1 forms to each partner as required.

- Fill out Schedule W-H for withholding tax on income of nonresident partners. Ensure accuracy in entering amounts and adhering to the withholding guidelines provided.

- Review the completed form for any errors before final submission. Once you are satisfied with the accuracy of your entries, you can save the changes, download, or print the form for your records.

Complete your SC DoR SC1065 form online to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Recent changes to South Carolina’s income tax laws have introduced new provisions that may affect your tax liabilities. These updates can influence tax rates, deductions, and filing requirements. Staying informed is essential, so reviewing the SC DoR SC1065 will provide the most current and relevant information. Consider leveraging this resource to navigate these changes effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.