Loading

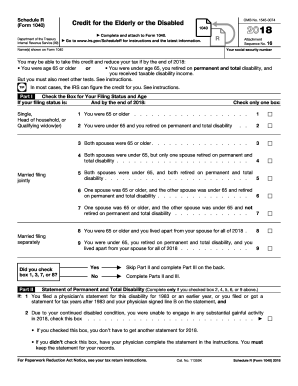

Get Irs 1040a Or 1040 Schedule R 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040A or 1040 Schedule R online

This guide provides a clear and supportive approach to filling out the IRS 1040A or 1040 Schedule R form online. Follow the step-by-step instructions to accurately complete your form and maximize your potential credits.

Follow the steps to complete your IRS 1040A or 1040 Schedule R online.

- Click the ‘Get Form’ button to access the IRS 1040A or 1040 Schedule R form, which you can then open and begin editing.

- Enter your name as it appears on Form 1040 along with your social security number.

- In Part I, check the appropriate box to indicate your filing status and age. Make sure to select only one option that applies to you.

- If you checked box 2, 4, 5, 6, or 9 in Part I, complete Part II by indicating if you have a physician's statement for your permanent and total disability.

- Proceed to Part III to calculate your credit. Fill in the amounts corresponding to your box selections from Part I.

- Complete any remaining calculations as prompted in Part III, following the detailed instructions provided.

- Once all sections are filled out, review your entries for accuracy.

- You can then save your changes, download, print, or share the completed form as needed.

Take the next step in your financial management and fill out your documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The elderly and disabled tax credit is generally non-refundable, meaning it can reduce your tax liability but will not result in a refund. If your tax owed is less than the credit amount, you will not receive the excess as a refund. Understanding this aspect is crucial for taxpayers using Schedule R on IRS 1040A. Always consult your tax advisor to determine how this credit affects your specific situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.