Loading

Get Irs 1040 - Schedule B 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule B online

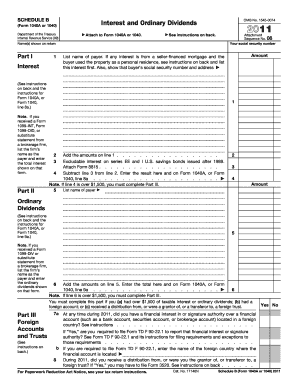

This guide will help you understand the IRS 1040 - Schedule B, which is necessary for reporting interest and ordinary dividends. Follow these clear instructions to fill out the form accurately while filing online.

Follow the steps to complete your Schedule B online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number and the name(s) as shown on your tax return at the top of the form.

- In Part I, report all taxable interest from forms such as 1099-INT or 1099-OID by listing the payer’s name and the amount received on line 1.

- If applicable, report any seller-financed mortgage interest first, providing the buyer’s social security number and address if necessary.

- Add up all amounts you have reported on line 1 and enter that total on line 2.

- Complete line 3 if you cashed series EE or I U.S. savings bonds issued after 1989 and paid qualified higher education expenses. You may need to exclude some interest from your total.

- In Part II, on line 5, report all ordinary dividends by listing each payer’s name and the corresponding amount as shown on your 1099-DIV.

- If you received dividends as a nominee, report the total on line 5, and provide a subtotal of all ordinary dividends. Then, indicate the nominee distributions accordingly.

- Move to Part III if you had over $1,500 of taxable interest or dividends, or if you have foreign accounts. Answer the questions on lines 7a and 7b as applicable to your situation.

- Once all sections are complete, save your changes, and review the form for accuracy. Download or print your completed Schedule B.

Start completing your IRS 1040 - Schedule B online to ensure accurate reporting of your interest and dividends.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Exempt interest dividends are typically reported directly on your IRS 1040 form, not on Schedule B. These dividends usually come from mutual funds, which specifically state that the dividends are exempt from federal income tax. Accurately reporting this information ensures you do not overstate your taxable income. Always check the instructions provided by the IRS or consider platforms like US Legal Forms for guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.