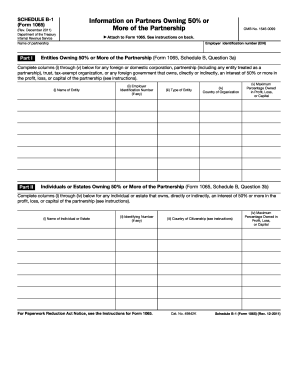

Get Irs 1065 - Schedule B-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 - Schedule B-1 online

How to fill out and sign IRS 1065 - Schedule B-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or you simply overlooked it, it could likely lead to complications for you.

IRS 1065 - Schedule B-1 is not the simplest form, but you have no reason to panic in any situation.

With our robust digital solution and its beneficial tools, completing IRS 1065 - Schedule B-1 becomes more efficient. Do not hesitate to utilize it and allocate more time to your hobbies and interests rather than managing paperwork.

- Open the document using our sophisticated PDF editor.

- Complete the necessary details in IRS 1065 - Schedule B-1, utilizing fillable fields.

- Add images, checkmarks, tick boxes, and text fields, if necessary.

- Repetitive fields will be populated automatically after the initial entry.

- If you encounter any confusion, activate the Wizard Tool. You will receive helpful hints for easier completion.

- Remember to include the date of submission.

- Create your unique electronic signature once and place it in the required fields.

- Review the details you have entered. Correct errors if necessary.

- Click on Done to complete modifications and choose how you will transmit it. You can opt for online fax, USPS, or email.

- You have the option to download the document for later printing or upload it to cloud services like Google Drive, OneDrive, etc.

How to modify IRS 1065 - Schedule B-1 2011: tailor forms digitally

Utilize the capabilities of the feature-rich online editor while filling out your IRS 1065 - Schedule B-1 2011. Employ the variety of instruments to swiftly complete the fields and supply the necessary information without delay.

Drafting documents is labor-intensive and costly unless you possess ready-to-use editable forms and finalize them electronically. The most efficient approach to handle the IRS 1065 - Schedule B-1 2011 is to employ our expert and versatile online editing resources. We offer you all the essential tools for rapid document completion and permit you to make any modifications to your forms, tailoring them to specific requirements. Additionally, you can annotate the changes and leave messages for other stakeholders.

Here’s what you are able to do with your IRS 1065 - Schedule B-1 2011 in our editor:

Engaging with the IRS 1065 - Schedule B-1 2011 in our powerful online editor is the quickest and most effective method to organize, submit, and share your documentation as per your needs from anywhere. The tool operates from the cloud, enabling you to access it from any location on any internet-enabled device. All forms you create or complete are safely stored in the cloud, ensuring that you can always retrieve them when needed without fear of loss. Stop spending time on manual document completion and eliminate paper; transition everything online with minimal effort.

- Complete the empty sections using Text, Cross, Check, Initials, Date, and Signature tools.

- Emphasize important details with a chosen color or underline them.

- Conceal sensitive information using the Blackout tool or simply delete it.

- Add images to illustrate your IRS 1065 - Schedule B-1 2011.

- Replace the original wording with the content that suits your requirements.

- Leave remarks or sticky notes to notify others about the changes.

- Insert extra fillable sections and designate them to specific individuals.

- Secure the template with watermarks, include dates, and bates numbers.

- Distribute the document in various formats and save it on your device or the cloud upon completing the editing.

Get form

The schedule B-1 form 1065 is a supplementary form that accompanies the partnership tax return. It specifically documents the ownership interests of each partner, which is crucial for tax compliance. This form is instrumental for the IRS in understanding the partnership structure and ensuring accurate tax reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.