Loading

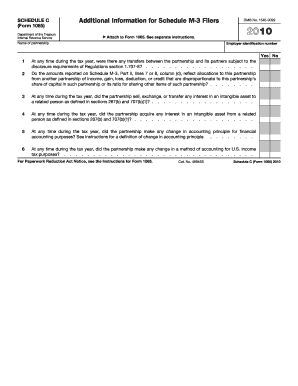

Get Irs 1065 - Schedule C 2010

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule C online

Filling out the IRS 1065 - Schedule C form online can seem daunting, but with clear guidance, it becomes manageable. This guide outlines each step to assist you in successfully completing the form.

Follow the steps to complete the IRS 1065 - Schedule C online.

- Press the ‘Get Form’ button to retrieve the IRS 1065 - Schedule C form and open it for editing.

- Enter the name of the partnership at the top of the form, as well as the employer identification number (EIN) associated with your partnership.

- Respond to any applicable 'Yes' or 'No' questions regarding transfers between the partnership and its partners, allocations from another partnership, and sales or exchanges of intangible assets.

- Indicate whether there was any change in accounting principles or methods for U.S. income tax purposes during the tax year by answering the respective questions.

- Review all the information entered for accuracy and completeness to ensure compliance with IRS regulations.

- Once you have completed the form, choose to save your changes, download the document for your records, print it for submission, or share it as necessary.

Start completing your IRS 1065 - Schedule C form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Absolutely, you can fill out your own IRS Form 1065, as long as you are familiar with the process and regulations. However, correctly completing this form can be complex, especially for those who are new to business tax filing. If you need assistance, consider using services like UsLegalForms, which can provide helpful resources and guides for ease of completion.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.