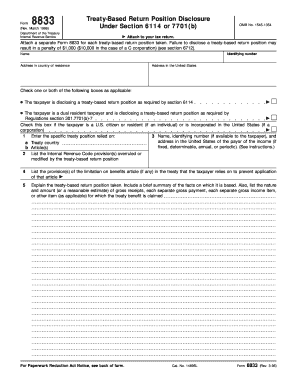

Get Irs 8833 1996

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8833 online

How to fill out and sign IRS 8833 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren't linked to document management and legal processes, completing IRS forms will be very challenging.

We recognize the significance of accurately finalizing paperwork. Our service provides the ideal solution to simplify the process of submitting IRS forms as effortlessly as possible.

Utilizing our comprehensive solution will enable efficient completion of IRS 8833, ensuring everything is set for your ease and convenience.

- The optimal way to fill out the IRS 8833 online:

Click the button Get Form to access it and begin editing.

Complete all required fields in the form using our user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

Verify the accuracy of the entered information.

Add the completion date for IRS 8833. Utilize the Sign Tool to create your personal signature for document validation.

Finalize editing by clicking Done.

Submit this form directly to the IRS in whichever manner is most convenient for you: via email, by digital fax, or postal mail.

You have the option to print it on paper if a copy is required, and download or save it to your preferred cloud storage.

How to revise Get IRS 8833 1996: personalize forms online

Utilize our extensive online document editor while processing your forms.

Complete the Get IRS 8833 1996, specify the crucial details, and smoothly adjust any other necessary modifications to its content.

Filling out documents digitally is not only efficient but also offers the flexibility to modify the template to fit your needs. If you plan to work on Get IRS 8833 1996, think about completing it with our powerful online editing tools. If you make a mistake or enter the required information in the wrong field, you can quickly amend the document without starting over as you would with manual filling. Additionally, you can emphasize the vital information in your documents by highlighting certain segments with colors, underlining them, or encircling them.

Our robust online solutions are the optimal way to complete and personalize Get IRS 8833 1996 according to your specifications. Use it to handle personal or business documents from anywhere. Access it in a browser, modify your documents as needed, and return to them at any time in the future - all your files will be securely stored in the cloud.

- Access the file in the editor.

- Enter the needed data in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any essential fields in the template.

- Encircle some of the key details and append a URL to it if necessary.

- Utilize the Highlight or Line tools to emphasize the most significant pieces of content.

- Choose colors and thickness for these lines to give your form a professional appearance.

- Remove or blackout the information you don’t want others to see.

- Replace elements containing errors and input the text you require.

- Complete modifications with the Done option when you are certain everything is accurate in the document.

Get form

Filing IRS Form 8833 is necessary if you wish to take advantage of benefits under a tax treaty. If you are a foreign national or a U.S. taxpayer claiming certain treaty benefits, this form is essential to properly report your tax situation. If you are uncertain about your requirement to file, consider consulting with a tax professional or using resources like US Legal Forms for guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.