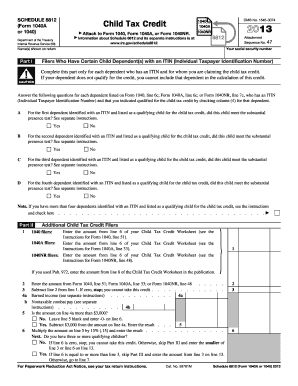

Get Irs 1040 - Schedule 8812 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule 8812 online

How to fill out and sign IRS 1040 - Schedule 8812 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period began unexpectedly or if you simply overlooked it, it could potentially lead to issues for you. IRS 1040 - Schedule 8812 is not the simplest form, but there is no need for concern regardless.

By utilizing our ultimate service, you will discover the correct method to fill out IRS 1040 - Schedule 8812 even in scenarios of significant time shortage.

With our robust digital solution and its helpful tools, filling out IRS 1040 - Schedule 8812 becomes simpler. Do not hesitate to engage with it and focus more on pastimes rather than on handling paperwork.

Launch the document in our sophisticated PDF editor.

Complete all necessary information in IRS 1040 - Schedule 8812, using the available fillable fields.

Add images, marks, checkboxes, and text boxes if necessary.

Repeating information will be incorporated automatically after the initial entry.

If there are any confusions, activate the Wizard Tool. It will provide helpful hints for simpler completion.

Remember to include the date of submission.

Create your distinct signature once and place it in all required areas.

Review the information you have entered. Amend any errors if needed.

Click on Done to conclude editing and select how you would like to send it. You will have the option to use virtual fax, USPS, or email.

You can even save the document to print it later or upload it to cloud storage.

How to modify Get IRS 1040 - Schedule 8812 2013: personalize forms online

Place the appropriate document management features at your disposal.

Execute Get IRS 1040 - Schedule 8812 2013 with our trustworthy solution that integrates editing and eSignature capabilities.

If you desire to complete and sign Get IRS 1040 - Schedule 8812 2013 on the internet without any hassle, then our online cloud-based system is the optimal choice.

Modify and annotate the template

The upper toolbar contains tools that enable you to emphasize and obscure text, omit images and graphical elements (lines, arrows, checkmarks, etc.), affix your signature, initialize, date the document, and much more.

Organize your documents

- We provide a rich template-based library of ready-to-use documents you can alter and complete online.

- Furthermore, there's no need to print the document or rely on third-party services to render it fillable.

- All necessary tools will be accessible for your use immediately upon opening the document in the editor.

- Let’s explore our online editing functionality and its primary features.

- The editor boasts an intuitive interface, ensuring quick familiarization.

- We’ll review three key components that enable you to:

Get form

Unfortunately, you will not qualify for the Child Tax Credit for your 18-year-old dependent. The IRS guidelines specify that dependents must be under 17 at the end of the tax year to be eligible. You will need to focus on your other tax deductions when completing your IRS 1040 - Schedule 8812.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.