Get Irs 1041 - Schedule K-1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule K-1 online

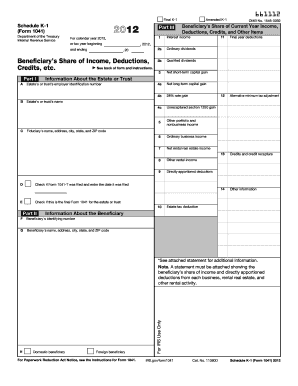

The IRS 1041 - Schedule K-1 is a key document used to report a beneficiary's share of income, deductions, credits, and other items from an estate or trust. This guide provides a clear and user-friendly process for completing this form online, ensuring that users can accurately report their information.

Follow the steps to complete your IRS 1041 - Schedule K-1 online.

- Click the ‘Get Form’ button to access the Schedule K-1 form and open it in your browser.

- Enter the estate's or trust's employer identification number in Part I, Box A. This information identifies the entity from which you are receiving distributions.

- Provide the estate's or trust's name in Box B, followed by the fiduciary's details, including their name, address, city, state, and ZIP code in Box D.

- Indicate whether the final Form 1041 for the estate or trust has been filed by checking the appropriate box in Box E and entering the date it was filed.

- In Part II, fill out information about the beneficiary in Box F, which requires the beneficiary's identifying number, and continue with their name and address in Box G.

- In Part III, report the beneficiary’s share of current year income, deductions, credits, and other items. Fill out each applicable field, including ordinary dividends, interest income, and capital gains.

- Ensure that any additional statements, as indicated in the form, are attached to the Schedule K-1 to provide extra details about the beneficiary's share of income and deductions.

- Once all fields are completed, review the form for accuracy. You can then save your changes, download, print, or share the completed Schedule K-1 as needed.

Start completing your IRS 1041 - Schedule K-1 online today for accurate reporting.

Get form

Related links form

You do not need to file a K-1 with the 1041 return, but you must provide it to each beneficiary for their individual filings. Each beneficiary uses the K-1 to report income, deductions, and credits on their tax returns. This process is crucial for ensuring compliance with tax laws. For easy access to necessary forms and guidance, consider checking out uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.