Get Irs 6765 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 6765 online

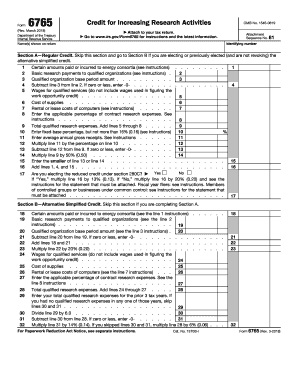

The IRS 6765 form is used to claim a credit for increasing research activities aimed at supporting innovation and research in the United States. This guide provides a clear, step-by-step approach to help users fill out the form online, ensuring that all necessary information is provided accurately.

Follow the steps to complete the IRS 6765 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the name(s) shown on your tax return in the designated field at the top of the form.

- Identify your identifying number, which is typically your Social Security Number or Employer Identification Number, and input it in the appropriate space.

- Move to Section A if you are claiming the regular credit. If you are electing or have previously elected the alternative simplified credit, skip to Section B.

- In Section A, fill out lines 1 through 17 with the necessary figures related to your qualified research expenses, including wages for qualified services, the cost of supplies, and any rental or lease costs of computers.

- In Section B, if applicable, repeat entering the required data as specified on lines 18 through 34, which focus on alternative simplified credit calculations.

- Proceed to Section C where you will calculate the current year credit using the information from previous sections, ensuring to follow instructions for partnerships or S corporations if relevant.

- If you qualify as a small business and are electing the payroll tax credit, complete Section D by checking the appropriate box and entering the amount that applies.

- Review all fields for accuracy before finalizing your form.

- Once completed, save your changes. You can download, print, or share the form as needed.

Begin filling out the IRS 6765 online today to take advantage of the research activities credit.

Get form

Related links form

To claim R&D credit against payroll tax, you need to fill out IRS Form 6765 and determine your eligible expenses. You can then use this credit to offset payroll tax liabilities, providing substantial savings for your business. This process can be complex, but using services like US Legal Forms can guide you in understanding your options and ensuring accuracy in your claims.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.