Loading

Get Irs 1040 - Schedule 8812 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 8812 online

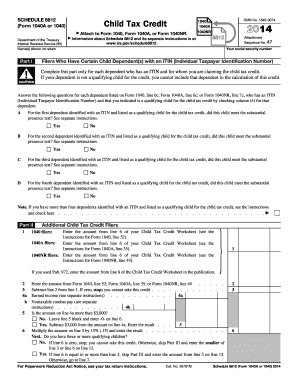

Filling out the IRS 1040 - Schedule 8812 online is essential for claiming the Child Tax Credit. This guide will provide you with straightforward, step-by-step instructions to ensure you complete the form accurately.

Follow the steps to fill out Schedule 8812 online:

- Press the ‘Get Form’ button to access the IRS 1040 - Schedule 8812 and open it for editing.

- Begin by entering your name as shown on your tax return and your social security number in the designated fields.

- In Part I, for each dependent with an ITIN, answer whether they meet the substantial presence test by selecting 'Yes' or 'No' for each dependent listed.

- Proceed to Part II and input amounts from your Child Tax Credit Worksheet as instructed based on your filing status (1040, 1040A, or 1040NR). Follow the calculations outlined for lines 1 to 6.

- In Part III, if applicable, enter the withheld social security, Medicare, and Additional Medicare taxes for yourself and your spouse (if filing jointly) in the provided lines.

- Finally, review all entries for accuracy, and upon completion, save your changes. You can download, print, or share the completed Schedule 8812 as needed.

Start filling out your IRS 1040 - Schedule 8812 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To complete the IRS 1040 - Schedule 8812, start by filling in your income details and the number of qualifying children you have. Follow the instructions carefully to ensure you calculate your child tax credit correctly. This form helps summarize how your credit is impacted by your income and family situation. Consider using our US Legal Forms to get step-by-step assistance throughout the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.