Get Irs 1041 - Schedule K-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule K-1 online

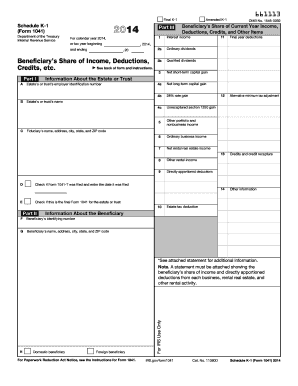

The IRS 1041 - Schedule K-1 is an essential form used to report a beneficiary's share of income, deductions, and credits from an estate or trust. This guide will help you navigate the process of completing this form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete your IRS 1041 - Schedule K-1 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Part I, provide the estate's or trust's identification number, name, and fiduciary's contact information as specified in the form.

- Indicate whether Form 1041-T was filed and enter the corresponding date.

- Complete Part II by filling in the beneficiary's identifying number, name, and address, while indicating their status as a domestic or foreign beneficiary.

- In Part III, accurately fill out the beneficiary’s share of current year income, deductions, credits, and other relevant items. Be sure to refer to the back of the form for detailed instructions if needed.

- Review all entries to ensure accuracy and completeness.

- Once finished, you can either save your changes, download, print, or share the completed form as required.

Complete your documents online for a smoother filing experience.

Get form

Related links form

The Schedule K-1 is generated by the individual or entity managing the estate or trust, commonly the executor or trustee. This process involves compiling financial information that reflects the distributions made to beneficiaries, leading to the completion of the IRS 1041 - Schedule K-1. It is essential to handle this accurately, as it provides the beneficiaries necessary information for their tax returns. If you're unsure about the process, consider professional assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.