Loading

Get Irs 1041 - Schedule K-1 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule K-1 online

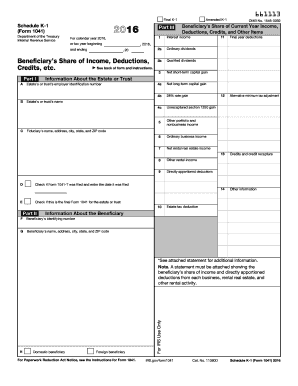

Filling out the IRS Schedule K-1 (Form 1041) can be a detailed process, especially for those unfamiliar with tax documentation. This guide aims to provide clear and concise steps to assist users in accurately completing the form online.

Follow the steps to fill out your IRS 1041 - Schedule K-1 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred viewing application.

- Begin by filling in Part I, which includes information about the estate or trust. This includes the employer identification number, name of the estate or trust, and the fiduciary's name and address.

- Complete the checkbox if Form 1041-T has been filed and provide the filing date. Indicate if this is the final Form 1041 for the estate or trust.

- Move to Part II to provide details regarding the beneficiary. Input the beneficiary's identifying number, name, address, city, state, and ZIP code. Additionally, indicate whether the beneficiary is domestic or foreign.

- In Part III, record the beneficiary's share of income, deductions, credits, and other items. Fill out sections for qualified dividends, capital gains, ordinary business income, rental income, and various deductions.

- Ensure that a statement is attached showing the beneficiary's share of income and directly apportioned deductions from each activity mentioned on the form.

- Finally, review the completed form for accuracy. Once satisfied, you can save changes, download the form, print it for your records, or share it as needed.

Start completing your IRS 1041 - Schedule K-1 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Anyone managing a trust or estate that earns income must file IRS Form 1041. This includes executors of estates or trustees of a trust. If you're unsure about your responsibilities, uslegalforms provides resources to help you understand and fulfill your obligations with ease.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.