Loading

Get Fincen 104 2011-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FinCEN 104 online

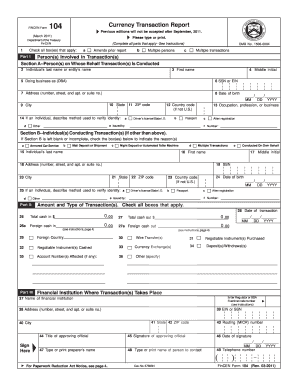

Completing the FinCEN Form 104 online can seem daunting; however, this step-by-step guide aims to simplify the process. The Currency Transaction Report is essential for reporting transactions over $10,000 and is important for compliance with financial regulations.

Follow the steps to successfully complete the FinCEN 104 form.

- Press the ‘Get Form’ button to obtain the FinCEN 104 online and open it in your preferred editor.

- Begin with Part I, which requires you to check the appropriate boxes for your report type — whether you are amending a prior report, reporting multiple persons, or multiple transactions.

- In Section A of Part I, fill in the information for the individual or entity on whose behalf the transaction is conducted. Complete items such as last name, first name, middle initial, date of birth, address, and SSN or EIN.

- For individuals conducting transactions on their own behalf, complete Section A and leave Section B blank. If on behalf of others, complete Section B with the names and relevant details.

- Move on to Part II, where you need to report the amount and type of transactions. Indicate the total cash in and cash out, along with details of any foreign currency involved.

- In Part III, provide information related to the financial institution where the transactions occurred, including institution name, address, and the EIN or SSN.

- Finally, ensure all sections are correctly filled out, and review the form for accuracy. Once completed, you can save changes, download, print, or share the form as needed.

Complete your FinCEN Form 104 online today to ensure regulatory compliance.

Related links form

To request access to FinCEN, you need to fill out an application that complies with their guidelines. Providing your information and reason for access is crucial in this process. Once you submit your request, FinCEN will review it and respond accordingly. Platforms like uslegalforms can guide you in making sure your application meets all necessary requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.