Loading

Get Sc Dor I-290 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR I-290 online

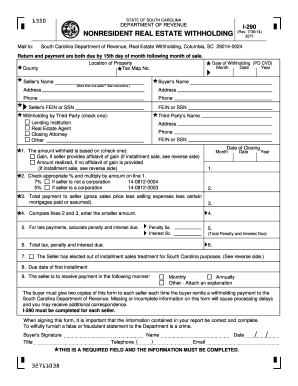

The SC DoR I-290 form is essential for nonresident real estate withholding in South Carolina. This guide provides a clear and supportive step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to fill out the SC DoR I-290 form online

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the location of the property by entering the county and tax map number. Ensure these details are accurate, as they are critical for processing.

- Enter the seller's name and address. Make sure all fields marked with an asterisk (*) are completed as they are required.

- Specify the date of withholding by filling in the month, date, and year in the respective fields.

- Provide the buyer's name and address, along with their phone number and tax identification (SSN or FEIN).

- Indicate the party responsible for withholding by checking the appropriate box (lending institution, real estate agent, etc.), and fill in their tax identification number.

- On line 1, enter the amount withheld based on the gain, or the amount realized from the sale, as applicable.

- Check the appropriate box on line 2 to determine withholding based on the provided options and multiply it by the amount on line 1.

- Calculate the total payment to the seller on line 2 by reducing the gross sales price by selling expenses and certain mortgages.

- Enter any penalty or interest due for late payments in lines 5a and 5b, as necessary.

- Confirm the total amount due, which includes tax, penalty, and interest on line 6.

- If applicable, check box 7 regarding the seller's election out of installment sales treatment.

- Finally, the buyer must sign and date the form, ensuring all required fields are completed correctly.

- You can save your changes, download the completed form, or print it for your records and submission to the relevant department.

Complete and submit your SC DoR I-290 form online for timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The $800 tax rebate in SC is a one-time rebate aimed at qualifying taxpayers filed under the SC DoR I-290 guidelines. This rebate directly benefits individuals and families that meet specific eligibility requirements. It serves as a financial relief measure, especially for those affected by various economic challenges.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.