Loading

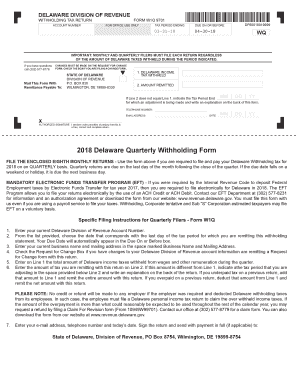

Get De W1q 9701 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE W1Q 9701 online

This guide provides a comprehensive overview of filling out the DE W1Q 9701 form online. Designed for ease of use, this document assists users in ensuring all necessary information is accurately reported and filed promptly.

Follow the steps to complete the DE W1Q 9701 form effectively.

- Press the ‘Get Form’ button to acquire the DE W1Q 9701 form and open it in your preferred online editor.

- Input your Delaware Division of Revenue Account Number in the designated field.

- Select the corresponding date for the last day of the tax period for which you are submitting the withholding statement; the due date will display automatically.

- In the space labeled ‘Business Name and Mailing Address,’ enter your current business name along with your mailing address.

- If there are any changes to your Delaware Division of Revenue account or if you are submitting a Request for Change form, check the appropriate box.

- On Line 1, enter the total amount of Delaware income taxes that were withheld from wages and other remuneration during the quarter.

- On Line 2, provide the amount of tax you are remitting. If this amount is different from Line 1, specify the tax period for the adjustment below Line 2 and include an explanation on the back of the form.

- Fill in your email address, telephone number, and today's date in the required fields. Don’t forget to sign the return.

- Submit the completed form with payment (if applicable) to the State of Delaware, Division of Revenue, PO Box 8754, Wilmington, DE 19899-8754.

Complete your DE W1Q 9701 form online today to ensure timely submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Delaware State income tax Extension form 1027 is used to request an extension for filing your personal income tax return. Completing this form allows you an additional six months to file your return, though payments are still due by the original deadline. For detailed guidance on filling out form 1027, US Legal Forms can be an invaluable tool.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.