Loading

Get Co Dr 0100a 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 0100A online

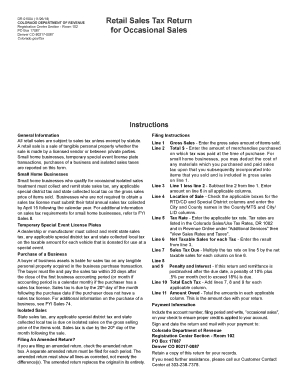

The CO DR 0100A form is essential for reporting retail sales tax for occasional sales in Colorado. This guide provides clear, step-by-step instructions to help users complete the form online efficiently.

Follow the steps to complete your CO DR 0100A form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information, including your Social Security Number (SSN), Federal Employer Identification Number (FEIN), and your last and first name or business name in the designated fields.

- Specify the due date for the form in the MM/DD/YY format.

- Complete the address section by entering your street address, city, state, and zip code.

- Fill in your phone number and Colorado account number.

- Indicate the period you are reporting for using the MM/YY-MM/YY format.

- If applicable, check the box indicating that this is an amended return.

- For line 1, enter the gross sales amount of items sold during the reporting period.

- For line 2, provide the total amount of merchandise purchased on which tax was paid at the time of purchase.

- Calculate line 3 by subtracting the amount on line 2 from line 1 and enter this amount on line 6 in all applicable columns.

- In line 4, check the appropriate boxes for the RTD/CD and special district columns, and enter the names of the county and city.

- For line 5, enter the applicable tax rate based on the location specified in line 4.

- Input the amount from line 3 (net taxable sales) onto line 6 for each tax category.

- Calculate the sales tax due for each column on line 7 by multiplying the tax rate from line 5 by the net taxable sales from line 6.

- If the return is submitted after the due date, calculate any penalties and interest for lines 8 and 9.

- Add the amounts from lines 7, 8, and 9 for each applicable column on line 10 to determine the total amount of taxes due.

- For line 11, total the amounts owed in all applicable columns and indicate this amount.

- Finally, sign and date the document, and ensure all necessary information is filled out accurately before submission.

- Save changes to the form, download, and print if necessary, or share as needed.

Complete your CO DR 0100A form online today to stay compliant with Colorado sales tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a withholding allowance form such as the CO DR 0100A, begin by collecting your information, including your filing status. Indicate the number of allowances you are claiming and review the state's guidelines for accuracy. Completing this form correctly helps ensure the right amount of taxes are withheld from your paychecks. For additional support, US Legal Forms can provide templates and resources tailored to your needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.