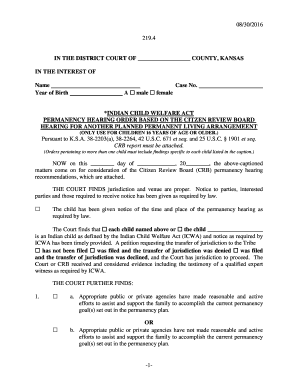

Get Ks Form 219.4 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KS Form 219.4 online

How to fill out and sign KS Form 219.4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

US Legal Forms seeks to assist you throughout the complete procedure of KS Form 219.4 preparation, while also making it quicker and more efficient.

The service will conserve your time and energy in drafting legal documents while ensuring confidentiality.

Never has KS Form 219.4 e-filing been so easy and swift as with US Legal Forms.

- Utilize the Search Engine to locate the sample.

- Access the form using the comprehensive online editor.

- Review the tips and guidelines in the template to avoid errors while entering mandatory details.

- To expedite the process, the fillable fields are highlighted in yellow. Just click on them and enter the necessary information.

- Once you have filled out all the applicable fields, date and sign the document.

- Thoroughly review the template for errors and inaccuracies and use the extensive top menu toolbar to modify the text.

- After finalizing the sample, click Done.

- Store the template on your device for future filing.

- E-file or print your legal document.

How to modify Get KS Form 219.4 2016: personalize forms online

Eliminate the clutter from your documentation routine. Uncover the simplest method to locate, modify, and submit a Get KS Form 219.4 2016.

The task of preparing Get KS Form 219.4 2016 requires accuracy and concentration, particularly from individuals who are not well acquainted with this type of work. It is crucial to obtain an appropriate template and populate it with the correct details. With the right solution for managing documentation, you can have all the resources readily available.

It is easy to streamline your editing experience without needing to acquire new skills. Identify the appropriate model of Get KS Form 219.4 2016 and complete it immediately without toggling between browser tabs. Explore additional tools to modify your Get KS Form 219.4 2016 in edit mode.

While on the Get KS Form 219.4 2016 page, click on the Get form button to begin editing. Input your information into the form directly, as all essential tools are conveniently available here. The template is already designed, so the user's effort required is minimal. Simply utilize the interactive fillable fields in the editor to effortlessly finish your paperwork. Just click on the form and switch to editor mode instantly. Fill in the interactive field, and your document is complete.

Often, a minor mistake can ruin the entire form when filled out manually. Eliminate inaccuracies in your documentation. Discover the templates you need in moments and complete them electronically through an intelligent editing solution.

- Insert additional text around the document if required.

- Utilize the Text and Text Box tools to add text in a separate box.

- Incorporate pre-designed graphic elements like Circle, Cross, and Check using their respective tools.

- If necessary, capture or upload images to the document with the Image tool.

- To draw on the document, utilize the Line, Arrow, and Draw tools.

- Use the Highlight, Erase, and Blackout tools to modify text in the document.

Related links form

When faced with the question 'Are you exempt from withholding?', you should answer honestly based on your eligibility. If you qualify for exemption under the conditions outlined in KS Form 219.4, you can answer affirmatively. However, if you do not meet the criteria, be transparent to avoid potential penalties. Understanding the implications of your answer is crucial, so take your time to review your options thoroughly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.