Get Ri Ri W-4 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI W-4 online

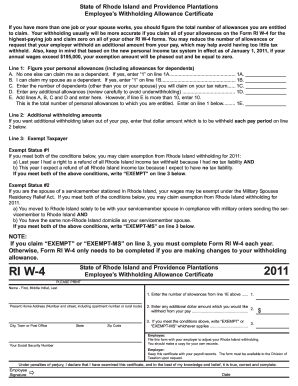

The RI RI W-4 form, also known as the Employee's Withholding Allowance Certificate, is essential for determining the correct amount of state income tax to withhold from your pay. This guide provides clear and supportive instructions to assist you in completing the form online.

Follow the steps to complete the RI RI W-4 online effectively.

- Click ‘Get Form’ button to access the RI RI W-4 form and open it in your editor.

- Begin by entering your personal information. This includes your name - first, middle initial, and last, as well as your present home address, city, state, and zip code.

- On line 1, calculate your personal allowances. First, determine if anyone can claim you as a dependent. If no one can, enter ‘1’ on line 1A. Next, check if you can claim your spouse as a dependent, entering ‘1’ on line 1B if applicable. Then, enter the number of dependents you will claim on your tax return on line 1C, followed by any additional allowances on line 1D. Finally, add lines 1A, 1B, 1C, and 1D to get your total allowances and enter that figure on line 1E, making sure it does not exceed 10.

- If you wish to have additional withholding from your paycheck, enter the amount on line 2.

- Evaluate whether you qualify for exemption from Rhode Island withholding. On line 3, enter 'EXEMPT' if you meet the conditions outlined for exempt status or 'EXEMPT-MS' if you are the spouse of a servicemember stationed in Rhode Island.

- Review all entries to ensure accuracy. Once you are satisfied with the details, check the declaration statement, fill in the date, and provide your signature at the bottom of the form.

- Submit the completed form to your employer for processing. It is advisable to retain a copy for your records.

Complete your RI RI W-4 online today to ensure accurate tax withholding!

Get form

Related links form

Filling out the RI W-4 is straightforward if you follow the provided instructions. Begin by entering your basic information, followed by determining your allowances, which will affect how much tax is withheld. You may also include any extra withholding amounts if desired. Finally, review the completed form and submit it to your employer; platforms like U.S. Legal Forms can provide templates and tips for extra help.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.