Loading

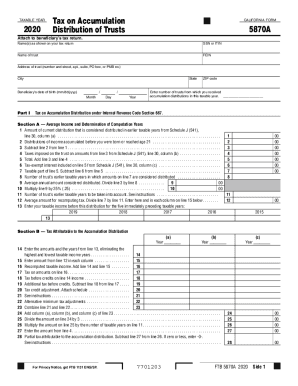

Get Ca Ftb 5870a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 5870A online

Filling out the CA FTB 5870A form online can seem daunting, but with this comprehensive guide, you will find it straightforward and manageable. This form is essential for reporting taxable income from accumulation distributions of trusts to ensure compliance with California tax regulations.

Follow the steps to successfully complete the CA FTB 5870A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year for which you are filing. Make sure this aligns with the tax periods you are intending to report.

- Fill out your personal information accurately, including name, social security number (SSN) or Individual Taxpayer Identification Number (ITIN), and address of the trust.

- In Part I, indicate the number of trusts from which you received accumulation distributions during the taxable year.

- Complete the detailed calculations in Section A regarding the average income and determination of computation years, including lines for current distributions and any applicable taxes.

- If applicable, complete Part II regarding any distributions of previously untaxed trust income and follow the instructions for Section A or B based on the duration of accumulation.

- Finally, ensure that all fields are filled accurately, review your entries for any discrepancies, and save changes to retain your information securely.

Complete and file your CA FTB 5870A online today to stay compliant with California tax laws.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.