Loading

Get Ri Ri W-4 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI W-4 online

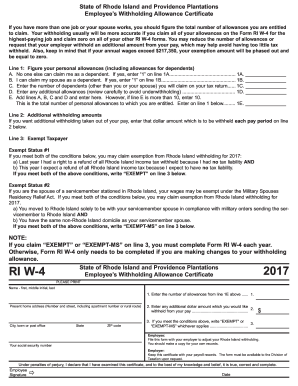

The RI RI W-4, also known as the Employee’s Withholding Allowance Certificate, is an essential form for employees in Rhode Island to determine the correct amount of state tax withholding. This guide will help you navigate the online process of filling out this form accurately and efficiently.

Follow the steps to complete the RI RI W-4 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name, including your first name, middle initial, and last name, in the designated field.

- Next, enter your present home address, including the number and street, any apartment number or rural route, city, town, or post office, state, and ZIP code.

- Now, move to line 1. Calculate the number of allowances you are entitled to claim by filling in lines 1A, 1B, 1C, and 1D based on your personal situation, and then total these allowances on line 1E.

- If you wish to have additional withholding, specify the dollar amount on line 2.

- If applicable, indicate your exempt status on line 3 by writing 'EXEMPT' or 'EXEMPT-MS' based on the conditions outlined earlier.

- Lastly, review the information provided for accuracy, then sign and date the form as the employee. Make sure to save your changes, download, print, or share the form as needed.

Complete your RI RI W-4 online today to ensure proper tax withholding!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Withholding on a paycheck refers to the portion of earnings that is withheld by your employer for taxes. This amount typically comes from federal, state, and sometimes local taxes, depending on your situation. The amount withheld can vary based on how you complete your RI W-4, making it important to fill out the form accurately to align with your tax liabilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.