Loading

Get Guarantor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guarantor Form online

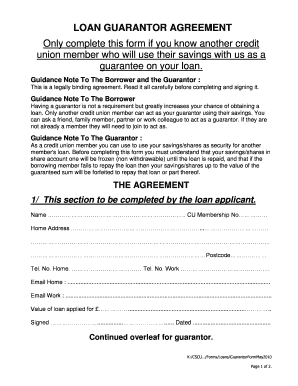

Completing the Guarantor Form online is a straightforward process that ensures you provide the necessary information to support a loan application. Follow the steps below to fill out the form accurately and efficiently.

Follow the steps to complete the Guarantor Form online:

- Press the ‘Get Form’ button to access the Guarantor Form and open it for editing.

- In the first section, enter your name and Credit Union membership number. Next, fill out your home address, including the postcode.

- Provide your home and work telephone numbers, along with your home and work email addresses.

- Indicate the value of the loan you are applying for, and ensure you sign and date this section.

- Move to the next section designated for the guarantor. The guarantor should enter their name and Credit Union membership number, followed by their home address and postcode.

- The guarantor must also fill in their home and work telephone numbers, as well as their home and work email addresses.

- The guarantor should state the total value of the loan they agree to guarantee, and read the agreement terms carefully.

- The guarantor must sign and date this section to confirm their understanding and agreement.

- Finally, the last section must be completed by a Credit Union representative, who will witness the signatures.

Complete your documents online today for a smooth process!

The guarantor signature is the signature of the individual who agrees to take responsibility for your obligations. This person signs the guarantor form, indicating their commitment to fulfill the financial responsibilities if you cannot. It’s a crucial step in establishing the legal binding of the agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.