Loading

Get Required Minimum Distributions - Security Benefit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Required Minimum Distributions - Security Benefit online

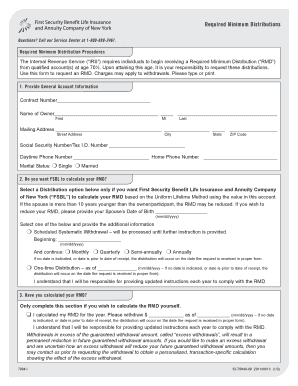

This guide provides a step-by-step approach to completing the Required Minimum Distributions form for Security Benefit. Understanding how to accurately fill out this form is crucial for compliance with IRS regulations regarding required distributions from qualified accounts.

Follow the steps to successfully complete your RMD form.

- Click ‘Get Form’ button to access the form and open it for completion.

- Provide general account information in the designated fields. This includes your contract number, name, mailing address, Social Security number, and daytime phone number. Additionally, indicate your marital status.

- If you would like FSBL to calculate your RMD, select the appropriate distribution option and provide any required information, such as your spouse’s date of birth if it applies.

- Indicate whether you wish to calculate your RMD yourself. If so, provide the calculated amount and the date you wish the amount to be withdrawn.

- Specify the distribution instructions by selecting how you want the funds to be withdrawn. Choose between prorated withdrawal or specific percentages from investment options as applicable.

- Decide on the federal income tax withholding. Select your preference for how much, if any, federal income tax you want withheld from your distribution.

- Choose your preferred method of receiving your distribution. Options include electronic funds transfer, wire transfer, or receiving a check.

- If you selected electronic funds transfer or wire transfer, provide your bank information, including bank name, account type, routing number, and account number.

- Finally, provide your signature and the date. Ensure that all required signatures are obtained, including any beneficiaries if applicable. Review all entries for accuracy.

Complete your Required Minimum Distributions form online today to ensure timely compliance with IRS regulations.

The account owner is taxed at their income tax rate on the amount of the withdrawn RMD. However, to the extent the RMD is a return of basis or is a qualified distribution from a Roth IRA, it is tax free.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.