Loading

Get Ucc Financing Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UCC Financing Statement online

Filling out a UCC Financing Statement online is an important step in securing interests in personal property. This guide will provide you with clear instructions on how to complete the form effectively, ensuring that all required information is accurately captured.

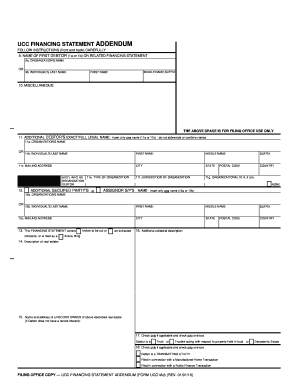

Follow the steps to successfully complete the UCC Financing Statement online

- Click ‘Get Form’ button to obtain the form and open it in your browser or document editor.

- Begin by entering the name of the first debtor in box 9, either as an organization or an individual. Ensure that the name matches exactly as shown in the related financing statement.

- In box 10, you may enter any miscellaneous information if required, but this is not mandatory.

- Complete box 11 if you are adding an additional debtor. Include the exact full legal name as per the instruction, and if necessary, you can attach further addendums for additional names.

- In box 12, provide the name and mailing address of the additional secured party, if applicable, following the formatting guidelines.

- In box 13, indicate if the financing statement covers specific types of collateral, such as timber or fixtures. Provide a detailed description in box 14 if it pertains to real estate.

- For box 15, include the name and address of a record owner of the described real estate if the debtor is not the record owner.

- In box 16, use the space provided for additional collateral descriptions if your earlier entry was insufficient.

- If applicable, check the boxes in items 17 and 18 to indicate if the debtor is a trust or if the transaction relates to a public finance transaction.

- After filling out the form, ensure all information is complete and accurate before saving your changes. You can download, print, or share the form as needed.

Start completing your UCC Financing Statement online today!

A UCC filing can be good or bad, depending on the context. For lenders, a UCC Financing Statement is beneficial as it secures their interests, giving them legal priority in case of borrower default. On the other hand, for borrowers, it may be seen as a negative mark, as it indicates outstanding debts. Overall, consider the situation to determine how it impacts your financial standing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.