Loading

Get Tax Number Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Number Application Form online

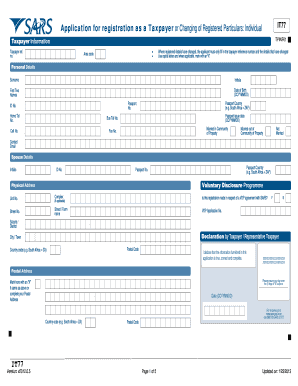

Filling out the Tax Number Application Form online is an essential step for individuals seeking to register as a taxpayer or update their registered details. In this guide, you will find clear and supportive instructions for completing each section of the form accurately and efficiently.

Follow the steps to complete the Tax Number Application Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the taxpayer reference number if applicable. If any registered details have changed, include only the changed information.

- Provide your personal details, including surname, initials, first two names, and date of birth in the format CCYYMMDD.

- Indicate your passport country and enter your passport number, ID number, and contact numbers, including home, business, and cell phone numbers.

- Complete the section for your marital status by marking 'X' for married in community of property, married out of community of property, or not married.

- Input your contact email address for communication purposes.

- Fill in your postal address details accurately, marking 'X' if it is the same as above.

- Review and double-check all entered information to ensure accuracy and completeness.

- Sign the application form by marking over the two lines of 'X's to declare that the information provided is true, correct, and complete.

- Finally, save your changes, download, print, or share the completed form as needed.

Begin your online application for the Tax Number now and ensure all your details are correctly submitted.

Related links form

To obtain a US tax file number, you need to complete the Tax Number Application Form. This form is crucial for identifying yourself to the IRS for tax purposes. You can either apply online or submit a paper application, depending on your situation. Once the IRS processes your application, you will receive your tax file number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.