Loading

Get Form 15g Download In Word Format 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15g Download In Word Format online

Filling out the Form 15g can seem daunting, but with clear guidance and a step-by-step approach, you can complete it with confidence. This form is essential for individuals who wish to declare their income and ensure that no tax is deducted at source.

Follow the steps to complete your Form 15g efficiently.

- Click the ‘Get Form’ button to access the Form 15g and open it in the editing tool of your choice.

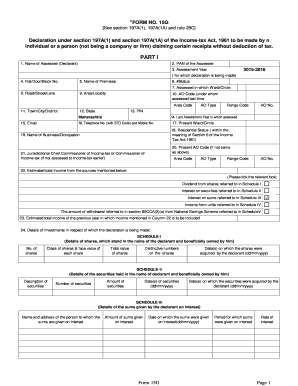

- In Part I of the form, enter the name of the assessee (declarant) in the first field. Then, provide the Permanent Account Number (PAN) in the next section.

- Specify the assessment year for which the declaration is being made. Ensure to use the correct format for this section.

- Fill out the address details, including flat or door number, premises name, status, and the ward or circle where assessed previously. Include the road, area, town, city, district, state, and PIN code.

- Provide contact information such as a telephone number (with STD code), mobile number, and email address.

- Indicate your residential status according to the Income Tax Act and declare your business or occupation details.

- Complete the section on estimated total income from specified sources by ticking the relevant boxes for dividends, interest on securities, or any other applicable income.

- Detail the investments related to your declaration in the corresponding schedules (Schedule-I to Schedule-V). Fill in the relevant fields with accurate information about shares, securities, sums given on interest, mutual fund units, and withdrawals from the National Savings Scheme.

- Sign to verify the declaration, affirming that the information is accurate, complete, and true to the best of your knowledge.

- Finally, review all details for accuracy. Save changes, download the completed form, print it for records, or share it as needed.

Start the process now and complete your Form 15g online with confidence.

Form 15G is a declaration form used by taxpayers to ensure no tax is deducted from certain income sources when their total income is below the taxable limit. For instance, if an individual's total income from interest is $3,000, they can use Form 15G to instruct the bank not to deduct tax. You can conveniently download Form 15G in Word format from our site, making it simple to process your financial matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.