Get Form 104 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 104 online

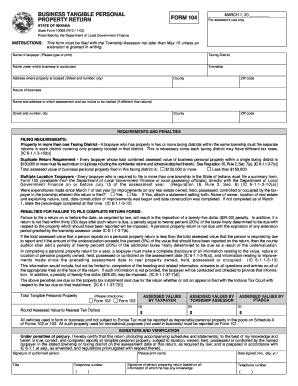

Form 104 is a vital document for reporting tangible personal property for tax purposes in Indiana. This guide will help you navigate the process of completing this form online, ensuring you provide accurate information and meet filing deadlines.

Follow the steps to complete your Form 104 online

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Begin by entering your name as the taxpayer. Ensure this is clearly typed or printed in the designated field.

- Next, identify your taxing district and the name under which your business operates. Fill in the township name and the complete address where the property is located, including street, city, county, and ZIP code.

- Indicate the nature of your business in the relevant field. This is important for assessing your property correctly.

- If different, provide the name and address for where assessment and tax notices should be mailed.

- Determine whether your property exists in more than one taxing district. If so, remember that you must submit separate returns for each district.

- If the total assessed value of your business personal property within the taxing district is $150,000 or more, prepare to file duplicate returns.

- Answer the question regarding any improvements made since March 1 of the previous year, and if applicable, attach the required statement detailing the improvements.

- Complete all necessary disclosures about your tangible personal property by checking the appropriate assessed values sections as instructed.

- Sign and verify your return, ensuring that all provided information is accurate to the best of your knowledge, and include contact information.

- Finally, save your changes, and you can choose to download, print, or share the form as needed.

Complete your Form 104 online today to ensure timely and accurate reporting of your tangible personal property.

Get form

Related links form

Filling out your tax details entails gathering required documentation and accurately entering that information on Form 104. Start with your W-2 forms, income sources, and applicable deductions. Use platforms like USLegalForms to help guide you through the process, ensuring that all necessary fields are completed correctly. By being organized and methodical, you can fill out your tax details with confidence.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.