Loading

Get John Hancock Ira Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the John Hancock IRA distribution form online

Completing the John Hancock IRA distribution form online can be a straightforward process when guided properly. This guide will walk you through each step, ensuring that you fill out the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to access the IRA distribution form and open it in the editor.

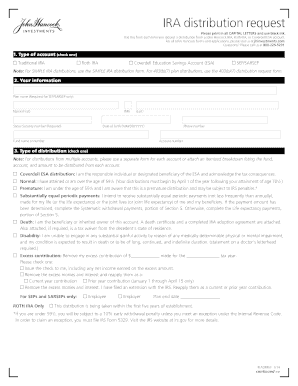

- Select the type of account from the options provided: Traditional IRA, Roth IRA, Coverdell ESA, or SEP/SARSEP. Ensure to choose one that matches your account type.

- Enter your personal information in the designated fields. Fill in your first and last name, middle initial, date of birth, and Social Security number. Include your phone number and account number as well.

- Indicate the type of distribution you are requesting by checking the appropriate box. Options include normal distribution, premature distribution, disability, and more. Provide any additional details requested for each type of distribution.

- Choose your income tax withholding preferences for federal and state taxes. Indicate whether you would like taxes withheld, and specify the rate, if applicable.

- Select the method of distribution. You can choose immediate payments or future payments. Depending on your selection, fill in the required information such as the amount or frequency of payments.

- Choose your preferred payment method. Options include mailing a check to your address, reinvesting proceeds, or wiring funds to a specified account. Provide any additional details required.

- In the signature section, certify your understanding of tax implications and sign the form. Ensure your signature matches the name on your account.

- Review all entered information for accuracy. After confirming that everything is correct, save the changes, download, print, or share the completed form as needed.

Complete your John Hancock IRA distribution form online today!

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.