Loading

Get Erca Pension Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Erca Pension Form online

Filling out the Erca Pension Form online is a straightforward process designed to help users declare pension contributions accurately. This guide will provide you with detailed instructions to complete each section of the form effectively.

Follow the steps to complete the Erca Pension Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

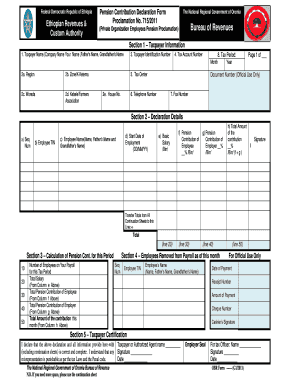

- In Section 1, enter the Taxpayer Information. Provide your full name, including your father's and grandfather's names, the Taxpayer Identification Number, Tax Account Number, and the Tax Period (month and year). Additionally, specify your region, zone, woreda, kebele/farmers association, tax center, and house number. Be sure to include your telephone and fax numbers as well.

- Proceed to Section 2, where you will declare details for each employee. Fill in the sequence number, employee's Tax Identification Number (TIN), and the names of the employee as well as their father's and grandfather's names. Input the start date of employment in DD/MM/YY format, basic salary, pension contribution percentages and amounts from both the employee and employer, and calculate the total amount of contributions.

- In Section 3, calculate the pension contributions for the period. This includes entering the number of employees on your payroll for the tax period, the total salary (column e from the previous section), total pension contributions from the employees (column f), and from the employers (column g). Lastly, provide the total contributions for the month (column h).

- In Section 4, declare any employees removed from the payroll for the month. Record the sequence number, employee TIN, and names, following the existing format.

- In Section 5, read and understand the Taxpayer Certification. After confirming the information's accuracy, provide your name, signature, and date. The employer's seal is also required here.

- Once you have filled out all the sections, save your changes. You will then have the option to download, print, or share the form as needed.

Begin filling out your Erca Pension Form online now to ensure timely submission and compliance.

For pension income, you typically receive the 1099-R form, which outlines your distributions. This form provides the necessary information for you to report your pension earnings. Utilizing the Erca Pension Form can enhance your ability to track and manage your pension income efficiently. Make sure to keep it handy during tax preparation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.