Loading

Get Rev 485 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 485 online

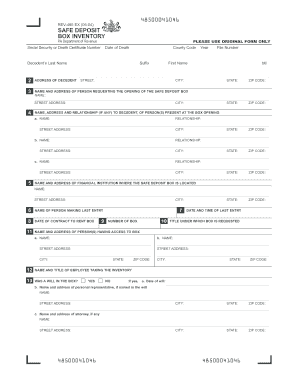

The Rev 485 is used to document the inventory of contents in a safe deposit box after a person's passing. This guide provides step-by-step instructions for accurately completing the form online to ensure compliance with the necessary requirements.

Follow the steps to fill out the Rev 485 form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date of death in the specified format (MM/DD/YYYY) at the beginning of the form. Ensure accuracy as this date is crucial for the document.

- Provide the Social Security or Death Certificate number for the decedent. This information is required to identify the individual's account correctly.

- Fill in the county code and year file number relevant to the case. This information can usually be found on official documents related to the decedent.

- Complete the decedent's last name, suffix, and first name, including middle initial where applicable.

- Next, provide the address of the decedent, including street, city, state, and zip code.

- Fill in the name and address of the person requesting the opening of the safe deposit box, ensuring that all fields are complete and accurate.

- List the names, addresses, and relationships (if any) of any individuals present at the box opening. It is important to accurately record everyone who is involved.

- Enter the name and address of the financial institution where the safe deposit box is located, including all necessary details like street and city.

- Continue by providing details about the last entry, including the name of the person making the last entry, the date of the contract to rent the box, and the number of the box.

- Indicate the date and time of the last entry into the box and include important notes such as whether a will was found in the box, along with its date and relevant representative information.

- Review all provided information for accuracy before signing the form, ensuring all required details are included.

- Once completed, users can save changes, download, print, or share the form as needed.

Complete your documentation by filling out the Rev 485 form online today.

Yes, you can file your PA local tax online, and the process is quite similar to filing state taxes. Most local municipalities provide online portals for tax filing. It’s beneficial to check if your local area requires the Rev 485 form during this process. For ease, uslegalforms can help you find the right forms and instructions tailored to your locality.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.