Get How Can Apply For Zakat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How Can Apply For Zakat online

Filling out the How Can Apply For Zakat form is a crucial step in accessing assistance through the Zakat program. This guide provides comprehensive and user-friendly instructions for completing the application online, ensuring that users can navigate the process with confidence.

Follow the steps to complete your Zakat application seamlessly.

- Click ‘Get Form’ button to access the Zakat application form and open it in your preferred document editor.

- Begin by entering the date of application, ensuring all fields are completed. Note that incomplete applications will not be considered.

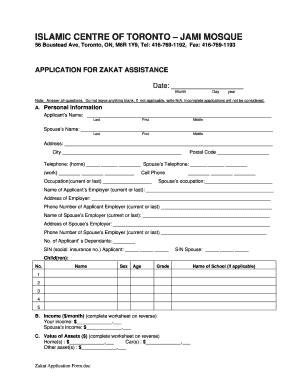

- In section A, provide your personal information, including your name, spouse’s name (if applicable), address, telephone numbers, occupations, and employer details. Make sure to answer all queries.

- Complete section C regarding the value of your assets. Be detailed and precise about your home, vehicles, and other assets.

- In section D, list your monthly expenditures, breaking down accommodation, food, clothing, and other expenses.

- Section E requires you to indicate the amount of assistance you are requesting from Zakat.

- In section F, provide your authorization signature, along with your spouse's signature, and date the application.

- Lastly, compile all necessary documentation to support your application, including proof of income and expenditures, and save, download, or print your completed form.

Take the next step in applying for Zakat assistance by completing and submitting your application online.

Individuals who do not meet specific financial criteria, such as the wealthy or those who possess more than the nisab, are typically not eligible for Zakat. Additionally, wealth that is designated for personal use or future investments may not qualify. Understanding these exclusions helps ensure that Zakat reaches those who genuinely need assistance. If you want to learn more about eligibility, uslegalforms offers valuable information on how can apply for Zakat.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.