Loading

Get How To File Form 10da Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To File Form 10da Online

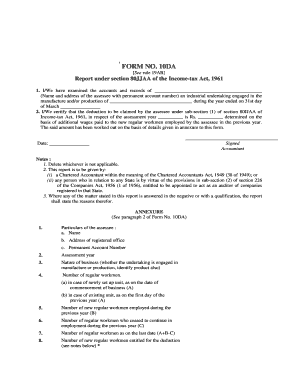

Filing Form 10DA is essential for assessing tax deductions under section 80JJAA of the Income-tax Act. This guide will help you understand the necessary steps to complete the form online effectively.

Follow the steps to accurately complete your form online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the name and address of the assessee along with their permanent account number at the top of the form.

- Indicate the industrial undertaking's nature by specifying the products manufactured or produced during the fiscal year ending on March 31.

- Certify the deduction amount the assessee will claim under section 80JJAA. This should be based on the additional wages paid to new regular workmen employed.

- Complete the annexure section by detailing the particulars of the assessee, including name, registered office address, and permanent account number.

- Specify the assessment year for which the deduction is being claimed.

- Provide the nature of business and identify the specific products related to the manufacturing or production activities.

- List the number of regular workmen in the previous year, distinguishing between newly set up units and existing ones.

- Indicate the number of new regular workmen employed during the previous year.

- Mention the number of regular workmen who ceased employment during the previous year.

- Calculate the total number of regular workmen as of the last date by applying the formula (existing + new - ceased).

- Note the number of new regular workmen entitled to the deduction, following the provided guidelines.

- Record the additional wages paid to the new regular workmen, ensuring clarity in calculating the 30% deduction from this amount.

- Finally, review the completed form for accuracy, then save your changes, download, print, or share the form as needed.

Complete your Form 10DA online today to ensure your tax deductions are correctly filed.

Form 10DA is a mandatory form to be filed while claiming deduction under section 80-JJAA. Given below are some important points related to Form 10DA : Due date of filing Form 10DA is as applicable to assessee for return filing u/s 139(1) as it is to be furnished along with the return of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.