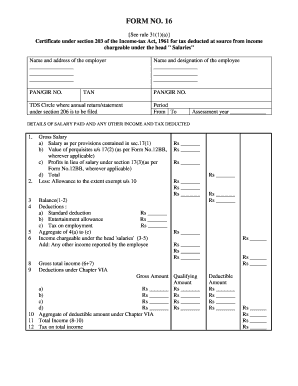

Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Tax Deducted At

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Tax Deducted At online

How to fill out and sign 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Tax Deducted At online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, tax, corporate as well as other electronic documents require a high degree of security and adherence to the regulations.

Our documents are frequently refreshed in line with the most recent regulatory updates.

Our service permits you to manage the entire process of completing legal documents online. Consequently, you save hours (if not days or even weeks) while avoiding additional costs. Henceforth, fill out 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Tax Deducted At Source From Income Chargeable Under The Head " from home, office, or while on the go.

- Access the template in our comprehensive online editing tool by clicking Get form.

- Complete the necessary fields highlighted in yellow.

- Press the green arrow labeled Next to navigate through the fields.

- Utilize the e-signature tool to insert a digital signature on the document.

- Include the date.

- Review the complete electronic document to ensure nothing has been overlooked.

- Click Done and save the finished document.

Modifying Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax: Tailor Forms Digitally

Take advantage of the convenience offered by the feature-rich web-based editor while completing your Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax. Utilize a variety of tools to swiftly fill in the gaps and furnish the necessary details promptly.

Creating documents can be lengthy and costly unless you have easy-to-use fillable forms and can complete them digitally. The optimal approach to manage the Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax is by employing our adept and versatile online editing tools. We offer you all the essential tools for rapid form completion and allow you to amend your templates, tailoring them to any specifications. Additionally, you can comment on updates and leave notes for other involved parties.

Here’s what you can accomplish with your Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax in our editor:

Distributing the documents in various formats or saving them on your device or in the cloud after adjustments is achievable. Utilizing the Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax in our robust online editor represents the fastest and most efficient method to organize, submit, and share your documents as you wish, accessible from any location using any internet-enabled device. All templates you create or modify are stored safely in the cloud, providing you with anytime access and assurance against loss. Cease wasting time on manual document completion and eliminate paper usage; transition everything online effortlessly.

- Fill in the blank spaces using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize key information with a preferred color or underline them.

- Conceal sensitive data with the Blackout tool or simply delete them.

- Upload images to depict your Get 16 See Rule 31(1)(a) Certificate Under Section 203 Of The Income-tax Act, 1961 For Withheld Tax.

- Swap the original text with your own as needed.

- Add comments or sticky notes to discuss updates with others.

- Remove additional fillable fields and assign them to specific individuals.

- Secure the template with watermarks, insert dates, and bates numbers.

To download your TDS certificate, you can visit the official income tax e-filing website. After logging in, navigate to the section for TDS and select the appropriate certificate under Section 203 of the Income Tax Act, 1961. Ensure you have the necessary details like your PAN or other identification ready. This digital convenience saves time and provides quick access to essential tax documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.