Get Form 18 Malawi 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 18 Malawi online

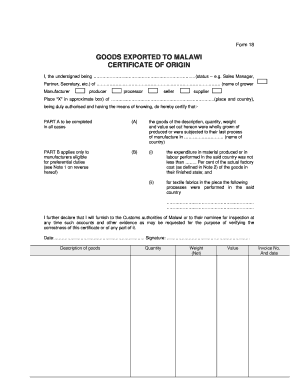

Filling out the Form 18 for exports to Malawi can seem daunting, but with clear instructions, it can be a straightforward process. This guide will walk you through each section of the form, providing detailed information to ensure accuracy and compliance.

Follow the steps to accurately complete the Form 18 Malawi online.

- Click 'Get Form' button to obtain the form and open it in your chosen editor.

- Begin by providing your status in the first section where it prompts you to indicate the position you hold, such as sales manager or partner.

- In the next field, enter the name of the grower or manufacturer responsible for the goods being exported.

- Indicate the location and country of the grower or manufacturer. This should be the place where the goods were produced or processed.

- Complete Part A by confirming that the goods listed were wholly grown or produced in the specified country, detailing the description, quantity, weight, and value.

- If your business is a manufacturer eligible for preferential duties, move to Part B. Enter the required percentage of material expenditure or labor performed in the said country.

- For textile fabrics, specify any processes performed in the said country as required in section B(ii).

- Provide a declaration statement indicating your readiness to furnish accounts and evidence to the Customs authorities for verification.

- Date the form and include your signature to authenticate the declaration.

- Fill in the description of goods, their quantity, net weight, and value before also entering the invoice number and date.

- Once all sections are completed, review your entries for accuracy, then save your changes, and download, print, or share the completed form as necessary.

Complete your Form 18 Malawi online today to ensure a smooth export process.

To apply for a Taxpayer Identification Number (TPIN) in Malawi, visit the Malawi Revenue Authority's local offices or their official website. By completing the necessary forms, which may include Form 18 Malawi, you can expedite your application process. It’s important to provide accurate information to avoid delays. After processing, you’ll receive your TPIN, which is essential for all your tax-related transactions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.