Get Tx Ll-10 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX LL-10 online

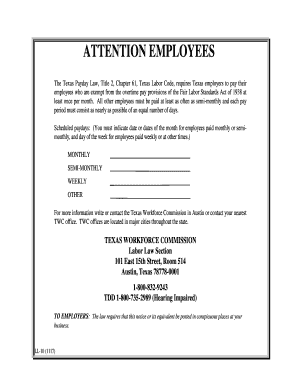

The TX LL-10 form is an important document for Texas employers, ensuring compliance with state law regarding employee pay schedules. This guide provides step-by-step instructions on how to complete the form online effectively and accurately.

Follow the steps to fill out the TX LL-10 form online

- Press the ‘Get Form’ button to access the TX LL-10 form and open it in the editing tool.

- In the designated section, specify the scheduled paydays for your employees. Choose whether they are paid monthly, semi-monthly, weekly, or at another frequency. Ensure to indicate the exact dates or days of the week as required.

- Provide the contact details of your nearest Texas Workforce Commission office if you have additional inquiries. Include the address and telephone number for easy reference.

- Review the completed form thoroughly to ensure all required fields are accurately filled out.

- Once satisfied with the information provided, save your changes. You may then download, print, or share the form, as needed.

Complete your TX LL-10 form online today to stay compliant with Texas labor laws.

To complete a Texas title transfer form, begin by entering the current owner's information and the buyer’s details. You will need to provide the vehicle's description, including the VIN and any other relevant specifics. Don’t forget to sign and date the document, as this step is crucial for its validity. With uslegalforms, you can easily access templates and detailed instructions to ensure that your title transfer is processed without issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.