Loading

Get Sg Iras Ir8a 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SG IRAS IR8A online

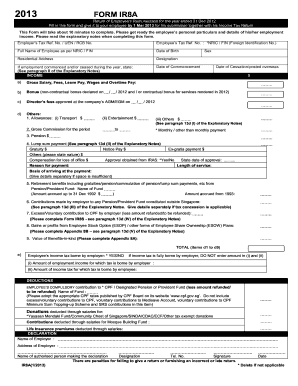

The SG IRAS IR8A form is essential for reporting employee remuneration to the tax authorities. This guide will help you navigate each section of the form effectively to ensure accurate submission by the due date.

Follow the steps to complete the SG IRAS IR8A form online.

- Press the ‘Get Form’ button to access the SG IRAS IR8A document and open it in the editor.

- Begin by entering the employer's tax reference number or Unique Entity Number. This information ensures your submission is associated with the correct employer.

- Enter the employee's tax reference number, which can be either their NRIC or Foreign Identification Number.

- Fill in the full name of the employee as indicated on their NRIC or FIN, ensuring accuracy to prevent discrepancies.

- Provide details of the employee's date of birth and residential address.

- List the employee's designation within the organization.

- If the employee commenced or ceased employment during the year, specify those dates and any relevant circumstances.

- Report income details, including gross salary, bonuses, director's fees, and any other relevant remuneration components. Ensure that you categorize each type clearly.

- For additional benefits, document allowances and contributions, ensuring to include all relevant details as requested in the form.

- Once all sections are filled out accurately, review the form for correctness. You can then save your changes and prepare to download, print, or share the completed document as needed.

Complete your SG IRAS IR8A form online today to ensure timely and compliant submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Choosing between a 401k and an IRA depends on your financial situation and retirement goals. A 401k may offer employer matching and higher contribution limits, while an IRA provides more investment flexibility. Each option has tax advantages, which can significantly impact your savings over time. To better understand how these accounts and related tax forms like SG IRAS IR8A affect your retirement, consider professional advice.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.