Loading

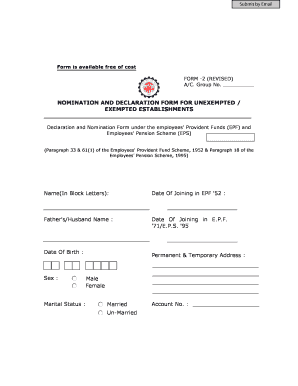

Get India Form-2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form-2 online

Filling out the India Form-2 is an essential process for nominating beneficiaries under the Employee Provident Fund and Employees Pension Scheme. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the India Form-2 online.

- Click the 'Get Form' button to access the India Form-2 and open it in your chosen editor.

- Begin by entering your name in block letters in the provided section at the top of the form.

- Provide the date of joining the EPF '52 in the designated field, followed by your father's or partner's name.

- Fill in the date of joining both EPF '71 and EPS '95, as well as your date of birth and sex, choosing between male and female.

- Input your permanent and temporary address in the respective sections.

- Indicate your marital status by selecting either married or unmarried.

- Enter your account number in the specified field.

- In Part A (EPF), nominate the person or persons you wish to designate for receiving benefits, filling in their names, addresses, relationships, and dates of birth as needed.

- If you have minor nominees, provide the name, relationship, and address of the guardian responsible for receiving amounts during the minor's minority.

- Affirm your declarations regarding family status and dependencies by signing or using your thumb impression in the designated area.

- In Part B (EPS), supply particulars about family members eligible for widow or children pensions, including names, addresses, relationships, and dates of birth.

- Nominate a person for receiving a monthly widow pension if no eligible family member remains, filling in their details appropriately.

- Conclude the form by signing or thumb impressing in the subscriber section, confirming all information is accurate.

- Finally, save your changes, and download, print, or share the form as needed.

Complete your India Form-2 online today to ensure your nominees are designated correctly.

The main difference between ITR-1 and ITR-2 lies in the income categories that each form covers. ITR-1 is generally for individuals with salaried income, while ITR-2 is suitable for those with more complex income sources, such as capital gains or income from other sources. Choosing the correct form is vital for accurate reporting, especially if you're filing using India Form-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.